after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 16, 2003

The average is ranging between 8161 and 9076, at the top end of the base that has been forming since July 2002; a bullish sign.

The primary trend is down and will only reverse up if the average rises above 9076 (the high from December 02).

The Nasdaq Composite lost 1.0% to close at 1423.

The primary trend is up.

The S&P 500 lost 4 points to close at 914. The short-term trend shows weakness.

The index ranges between 965 and 768, establishing a base. It has recently held above 867; a bullish sign.

The Chartcraft NYSE Bullish % Indicator increased to 52% (January 15).

The likelihood of another gulf war draws closer as UN weapons inspectors find empty chemical warheads.

Gold

New York: Spot gold reached a 5-year high, up 690 cents at $US 357.50

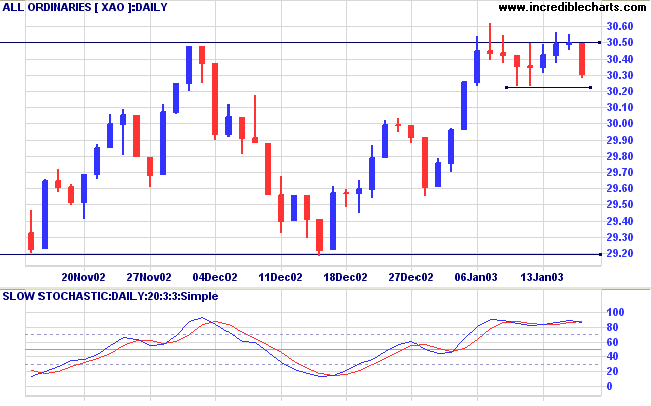

The index ranges between 2915 and 3050, forming a base.

Slow Stochastic (20,3,3) has crossed to below its signal line; MACD (26,12,9) is above; Twiggs money flow is falling.

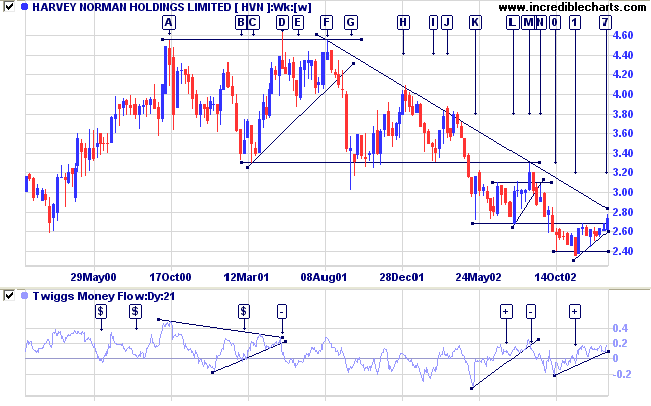

HVN formed a triple top at [A], [D] and [F] before entering a stage 4 down-trend. Note the false break at [D]; a strong bear signal.

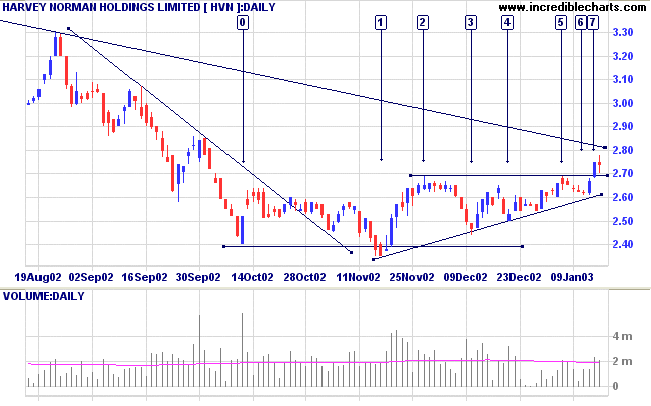

The stock then appeared to form a base at [K] to [L], followed by a break above resistance at [M]. This proved to be a bull trap, with a break below the trendline at [N]; a very reliable bear signal if traders are able to reverse their mind-set quickly enough to catch it. We are now presented with another potential bottom: a low at [0] followed by a false break at [1] and an ascending triangle to [7].

Relative strength (price ratio: xao) is starting to rise; MACD has completed a bullish divergence but has not yet broken above the long-term trendline; Twiggs money flow signals accumulation, having completed a bullish divergence [+].

HVN is now forming a congestion pattern just above the new support line. A break above the congestion pattern, especially if accompanied by strong volume, will be a bullish signal.

Conservative traders may wait until the stock has broken above the long-term trendline, on the weekly chart or on the MACD indicator.

For further guidance see Understanding the Trading Diary.

- Another paradox. To conquer our fear we must not fight it but accept it.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.