The Subscription/Registration forms are ready but we do not want to make them available until the free trial has started.

The free trial period will be extended to run for at least 4 weeks from when the new data is available.

The index is forming a base between 7500 and 9130.

The primary trend is down and will only reverse up if the average rises above 9076 (the high from December 02).

The Nasdaq Composite gained 2.7% to close at 1438, in a strong short-term up-trend.

The primary trend is up.

The S&P 500 closed 18 points up at 927.

The index ranges between 965 and 768, establishing a base.

All three indices have failed to re-test support at their 6-month lows, a bullish sign.

The Chartcraft NYSE Bullish % Indicator increased to 52% (January 08).

Technology stocks were boosted after better-than-expected results from software house SAP AG and network equipment-maker Foundry Networks. (more)

Gold

New York: Spot gold eased 120 cents to $US 352.10

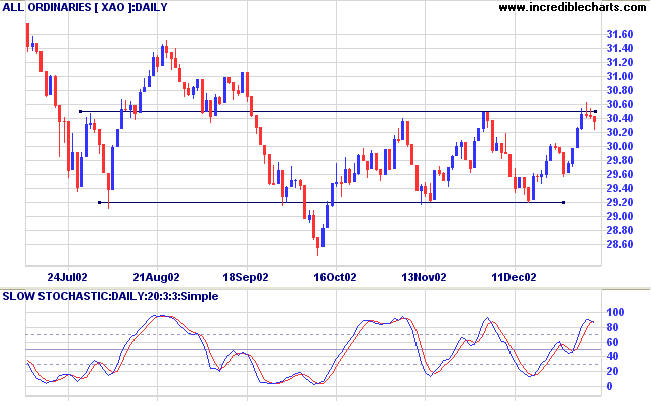

The index ranges between 2915 and 3050, forming a base. A break above 3050 will signal a primary trend change to an up-trend. Look for volume confirmation.

Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is above; Twiggs money flow is falling.

For further guidance see Understanding the Trading Diary.

must be ruled by the rock.

- Seafaring proverb

from Ruth Barrons Roosevelt: Exceptional Trading - The Mind Game

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.