For the next week I will be on holiday and will not have access

to broadband cable.

I will post the daily update on the

website but will be unable to send the email newsletter.

Wishing you a happy and prosperous New Year,

Colin

The index is building a base between 7500 and 9130.

The primary trend is down and will only reverse up if the average rises above 9076 (the high from December 02).

The Nasdaq Composite closed 0.3% down at 1335.

The primary trend is up.

The S&P 500 closed unchanged at 879.

The index is ranging between 965 and 768, establishing a base.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 31).

Is January a good barometer for the year's performance? (more)

Gold

New York: Spot gold is back up 330 cents at $US 347.50.

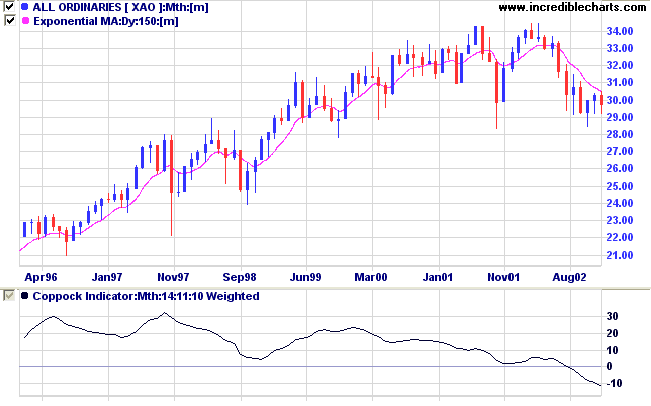

The index ranges between 2915 and 3050, building a base.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs money flow signals accumulation.

The monthly Coppock indicator is below zero and falling. An up-turn below zero signals the start of a bull market.

For further guidance see Understanding the Trading Diary.

And a time for every matter under heaven:

A time to be born, and a time to die;

A time to plant, and a time to pluck up what is planted;

A time to kill, and a time to heal;

A time to break down, and a time to build up;

A time to weep, and a time to laugh;

A time to mourn, and a time to dance;

A time to throw away stones, and a time to gather stones together;

A time to embrace, And a time to refrain from embracing;

A time to seek, and a time to lose;

A time to keep, and a time to throw away;

A time to tear, and a time to sew;

A time to keep silence, and a time to speak;

A time to love, and a time to hate,

A time for war, and a time for peace.

- Ecclesiastes 3:1-8

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.