Trading Diary

December 27, 2002

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite lost 20 points to 1348.

The primary trend is up.

The S&P 500 closed 15 points down at 875. The index is ranging between 965 and 768, establishing a base.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 26).

Gold is expected to outperform the market in the first quarter but bonds do not have a rosy outlook. (more)

Gold

New York: Spot gold eased 30 cents to $US 348.90.

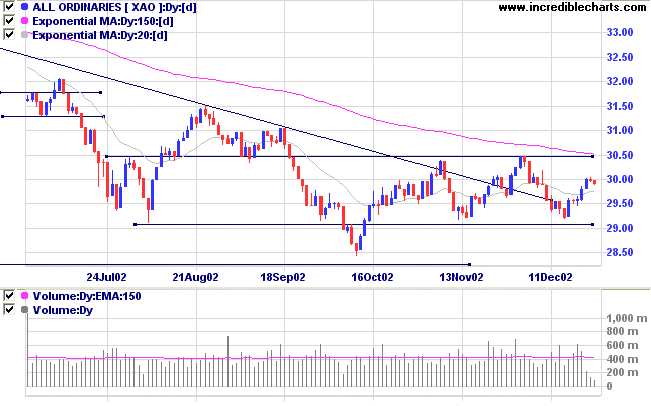

The index continues to range between 2915 and 3050, building a base.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs money flow signals accumulation.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is falling)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 4 (RS is falling)

- Health Care [XHJ] - stage 1 (RS is level)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is level)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 42 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Broadcasting & Cable TV

- Construction & Engineering

- Gold

For further guidance see Understanding the Trading Diary.

which nourishes all things without trying to.

- Lao Tse.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.