Trading Diary

December 23, 2002

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite gained 1.3% to close at 1381.

The primary trend is up.

The S&P 500 closed 2 points up at 897. The index is ranging between 965 and 768, establishing a base.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 20).

Crude oil futures reach a 2-year high as tension over Iraq escalates and Venezuelan strikes continue.

Gold

New York: Spot gold is back up 500 cents at $US 345.30.

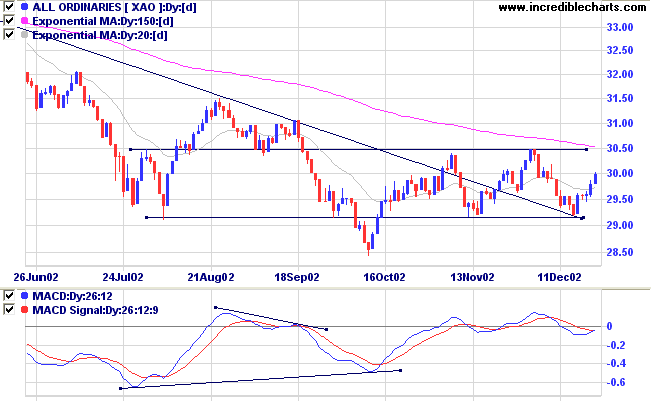

The index continues to range between 2915 and 3050, building a broad base.

MACD (26,12,9) crossed to above its' signal line; Slow Stochastic (20,3,3) is above its' signal line; Twiggs money flow signals accumulation.

For further guidance see Understanding the Trading Diary.

to put the nation in order, we must first put the family in order;

to put the family in order, we must first cultivate our personal life;

we must first set our hearts right.

- The Analects of Confucius.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.