In 2003 we plan to separate membership into two categories.

I see from discussion on the Chart Forum that some members would prefer to select the specific services that they require and omit the others.

What I may have failed to explain yesterday is that, whether we provide a service to 1 member or to 100 members, the cost is about the same. Hence our approach: If a member subscribes for one service, they will receive all the other services at no extra charge.

Please give us your feedback/suggestions at the Chart Forum.

Trading Diary

December 17, 2002

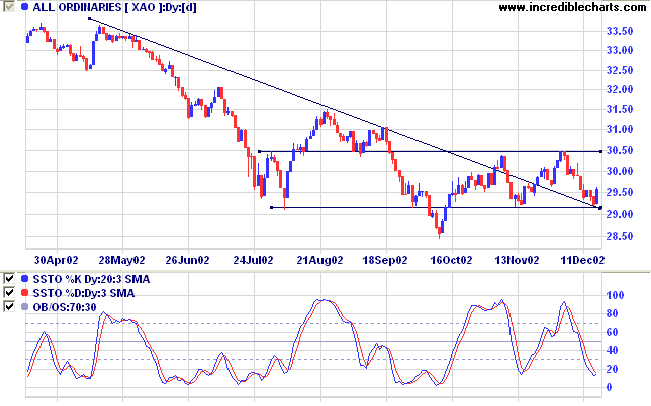

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite was down 0.6% at 1392.

The primary trend is up.

The S&P 500 formed an inside day, down 8 points at 902.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 16).

The Dow stalwart expects to take its first ever quarterly loss after a $US 435 million charge for store closures and job cuts. (more)

Gold

New York: Spot gold is up 40 cents at $US 336.70, after reaching 341.00 intra-day.

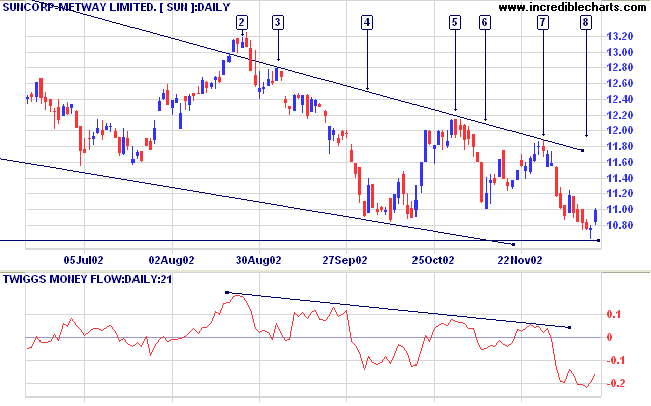

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines, but the Slow Stochastic appears about to cross. Twiggs money flow is just above zero.

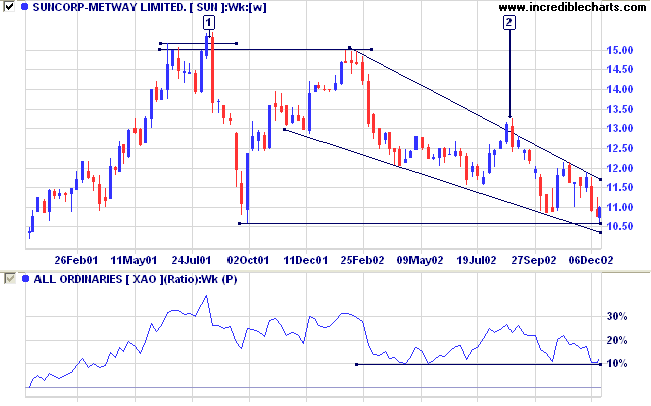

Last covered on August 29.

Relative strength (price ratio: xao) is holding above the support level. A break below support would be bearish.

For further guidance see Understanding the Trading Diary.

To think and not study is dangerous.

- The Analects of Confucius: 2.15

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.