In 2003 we plan to separate membership into two categories:

-

Full Members will receive:

~ The Daily Trading Diary, with regular new features on technical analysis and trading, and additional coverage of the US markets;

~ A new premium version of Incredible Charts with enhanced data, enabling charts to be adjusted for company actions such as share splits, rights issues and dividends; and

~ Free access to a number of features as they are added in 2003, including US indices and 20-minute delayed data from the ASX.

-

Free Members

Will continue to receive free updates to Incredible Charts software and the existing data feed, as well as access to the Chart Forum and website.

I will provide further details over the next few days.

Trading Diary

December 16, 2002

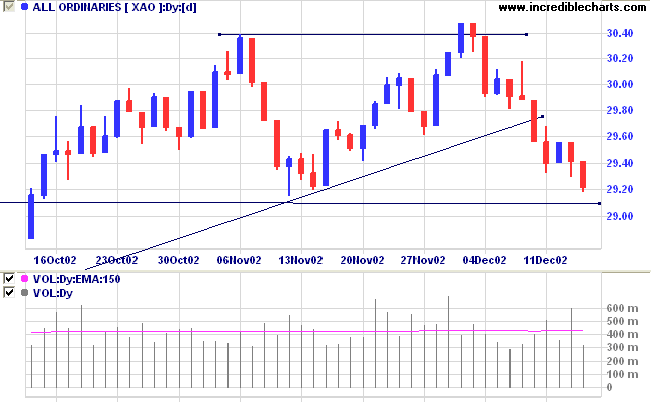

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite gained 2.8% to close at 1400.

The primary trend is up.

The S&P 500 also put in a strong rally, gaining 21 points to close at 910.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 13).

Some traders predict a seasonal bounce when institutions resume buying in January, after cleaning up their portfolios in the last quarter. (more)

Gold

New York: Spot gold continues to climb, up 330 cents at $US 336.30, another five-year high.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs money flow is just below zero.

For further guidance see Understanding the Trading Diary.

Difference is that strong people admit their mistakes, laugh at them, learn from them.

That is how they become strong.

- Richard Needham

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.