The newsletter over the holiday season will be shorter, with fewer stocks covered,

as we take a break from the market.

Trading Diary

December 13, 2002

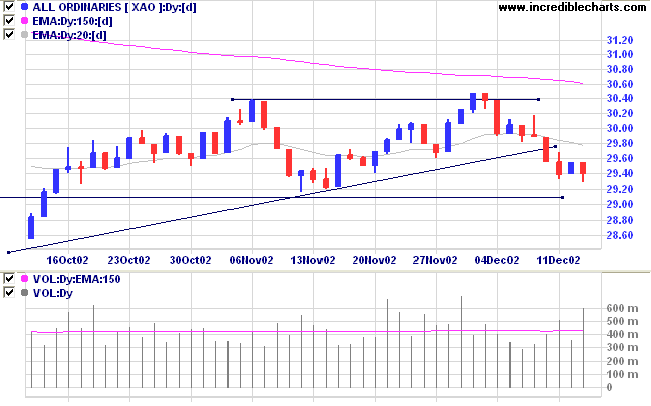

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite is in a strong down-trend, losing 2.6% to close at 1362, and appears set to test support at 1200 and 1100.

The primary trend is up.

The S&P 500 lost 12 points to close at 889.

The index is in a strong down-trend after two equal highs, on August 22 and December 2, and may test the October low of 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 50% (December 12).

University of Michigan's consumer sentiment index increased to 87.0, from 84.2 last month. (more)

Gold

New York: Spot gold climbed a further 170 cents to $US 333.00, a new five-year high.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs money flow is just above zero.

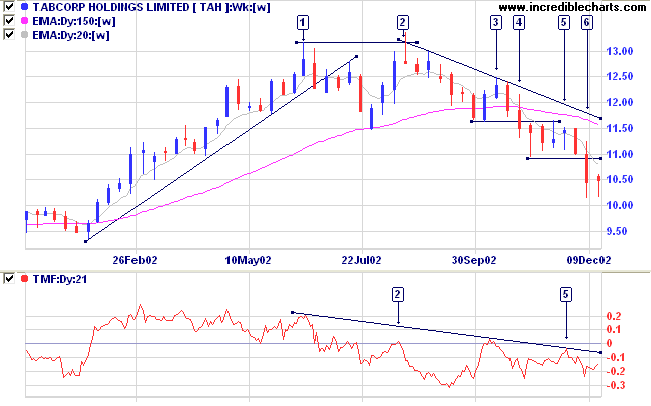

Last covered on August 15.

After a strong up-trend in the first half of the year TAH formed a double top, with a false break at [2], accompanied by a bearish divergence on Twiggs money flow, giving an early indication of a reversal. Price then entered a slow/creeping down-trend before a fast break downwards at [6] following a strong bear signal at [5] on Twiggs money flow, with a peak below zero.

Relative Strength (price ratio: xao) and MACD are bearish.

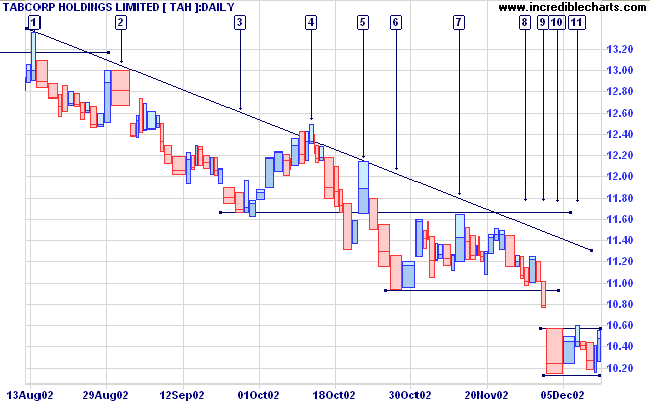

The false break can be clearly seen on the equivolume chart at [1], with a long shadow and low volume. The rally at [2] was of short duration with strong volume on the sell-off, confirming that TAH is in a down-trend. The next rally at [4] was stronger but gave way to a sharp resumption of the down-trend, followed by a short counter-trend with a long shadow at [5].

After the low at [6] TAH entered a period of congestion for over a month before a breakout at [9] and a gap to [10] on strong volume. We now see further congestion with the highs failing to close the earlier gap.

Rectangular congestion patterns usually signal continuation in a strong trend. A break below the low of [10] will be a strong bear signal, while a closing of the gap to [9] would be a bull signal.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is falling)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 4 (RS is falling)

- Health Care [XHJ] - stage 1 (RS is level)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is level)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 45 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Pharmaceuticals

- Agricultural Products

- Forest Products

- Gold

For further guidance see Understanding the Trading Diary.

but only at tremendous personal cost.

A driving desire for fame usually has at its root a fundamental lack of self-confidence and self-respect,

and any fame achieved on that basis will be empty and meaningless.

The extent to which you are motivated solely by the desire for money and fame

is the extent that you will fail as a person, and usually as a businessperson as well.

- Victor Sperandeo: Methods of a Wall Street Master

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.