When replying to a private message received from the Chart Forum:

-

Click on the link below the message:

If you would like to reply to this message by sending a private message of your own through the discussion board, use the following link to send your reply:

https://forum.incrediblecharts.com/userscripts/forums/board-profile.plx?action=sendmsg&to=colin_twiggs&db=1

-

Do not use the normal Reply button in your

Email program - this will not reach the intended

recipient.

Trading Diary

December 04, 2002

The primary trend is still down. It will reverse up if the average rises above 9130.

The Nasdaq Composite index gapped down further to close 1.3% down at 1430.

The primary trend is up (the index is above 1426).

The S&P 500 closed down 3 points at 917.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 50% (December 03).

New York: Spot gold is up 150 cents to $US 321.90.

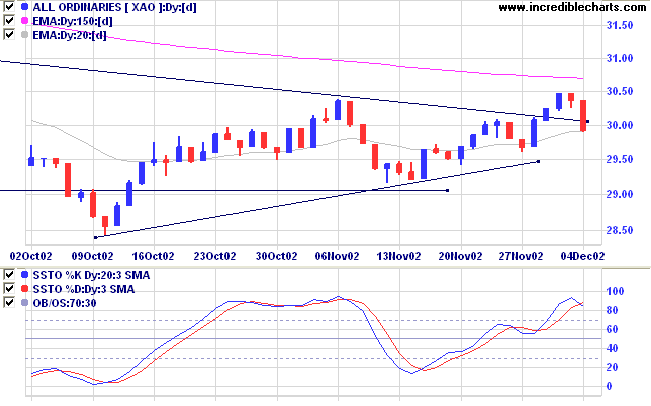

The primary trend will reverse (up) if the index rises above 3150.

The Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is above; Twiggs money flow signals accumulation.

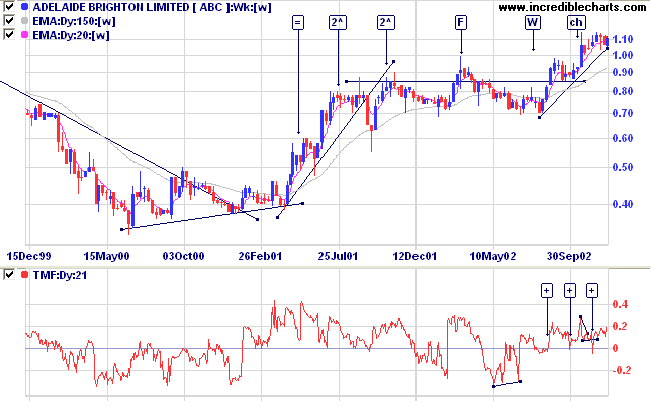

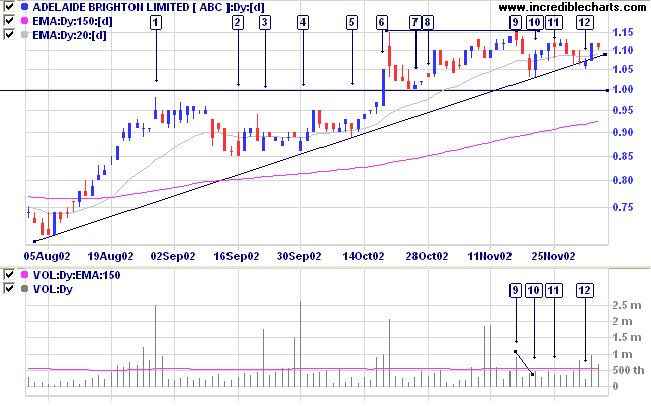

After a strong rally in the first half of 2001, ABC entered a period of consolidation, failing to hold a new high at [F], before establishing a base at 0.70 [W]. A cup and handle pattern is visible at [F] to [ch].

Relative strength (price ratio: xao) is rising, as is MACD. Twiggs money flow shows strong accumulation.

For further guidance see Understanding the Trading Diary.

but he who has mastered himself is mightier still.

- Lao Tse.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.