An archive of all past newsletters can be found at Trading Diary Archives.

Trading Diary

November 29, 2002

The Nasdaq Composite index closed down slightly at 1468.

The S&P 500 closed almost unchanged at 936.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 48% (November 27).

New York: Spot gold gained 110 cents to $US 318.70.

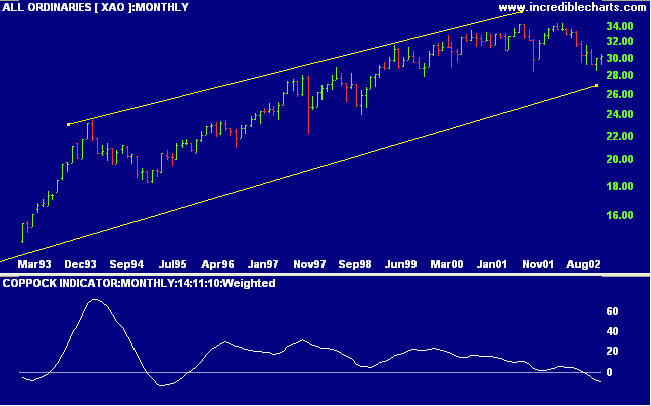

The primary trend will reverse if the index rises above 3150.

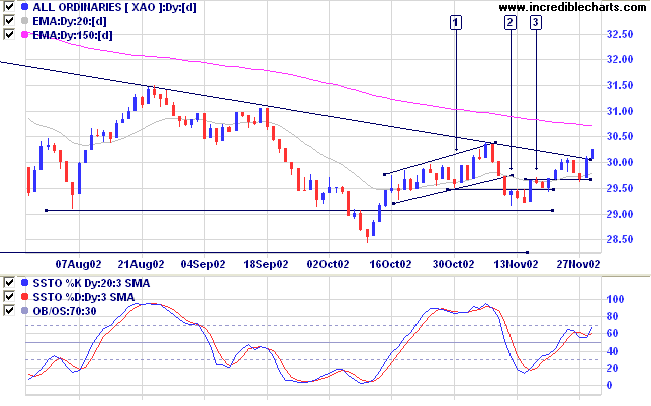

The Slow Stochastic (20,3,3) has crossed back above its signal line; MACD (26,12,9) is above; Twiggs money flow has respected the zero line, a bullish signal.

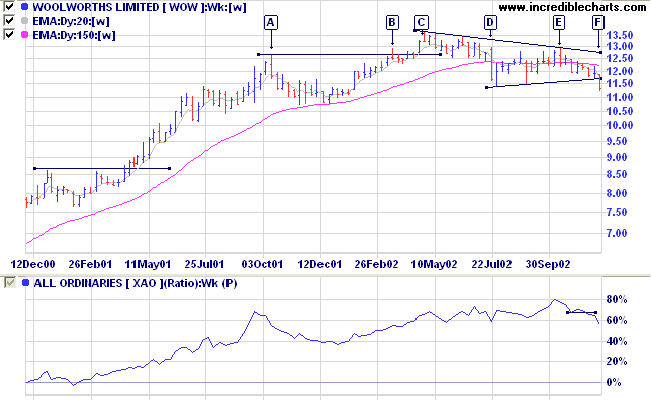

Last covered on August 26.

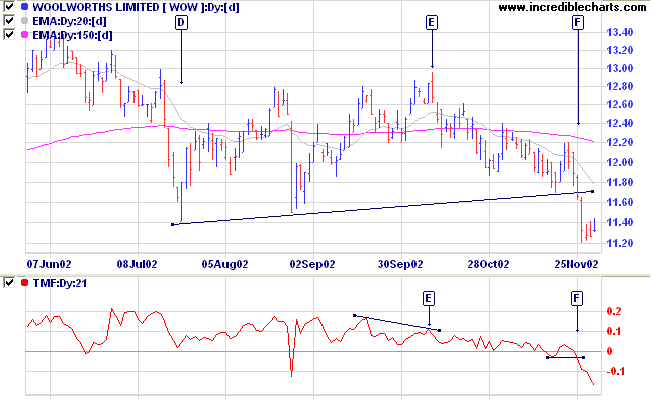

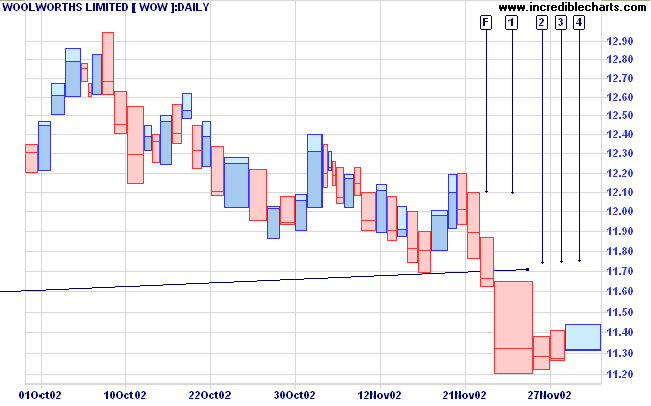

WOW formed a stage 3 top, in the shape of a a symmetrical triangle, after a long up-trend. Price has now broken out below the triangle at [F]. Relative strength (price ratio: xao) is falling.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is falling)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 4 (RS is falling)

- Health Care [XHJ] - stage 1 (RS is level)

- Property Trusts [XPJ] - stage 3 (RS is level)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 36 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Diversified Metals & Mining

- Pharmaceuticals

- REITs

For further guidance see Understanding the Trading Diary.

that prevents us from learning.

- Claude Bernard (1813 - 1878), founder of experimental medicine.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.