The Start New Thread link has been moved to the head of the Topics page.

Members previously had difficulty locating it on pages with large numbers of threads.

Trading Diary

November 26, 2002

The primary trend will reverse (up) if the index rises above 9130.

The Nasdaq Composite Index lost 2.5% to close at 1444.

The primary trend is up.

The S&P 500 lost 19 points to close at 913.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 48% (November 25).

Merrill Lynch has already paid $100 million to settle conflict-of-interest charges. Other firms face even bigger fines for hyping analysts reports to win investment banking business. (more)

Gold

New York: Spot gold is down 10 cents at $US 317.60.

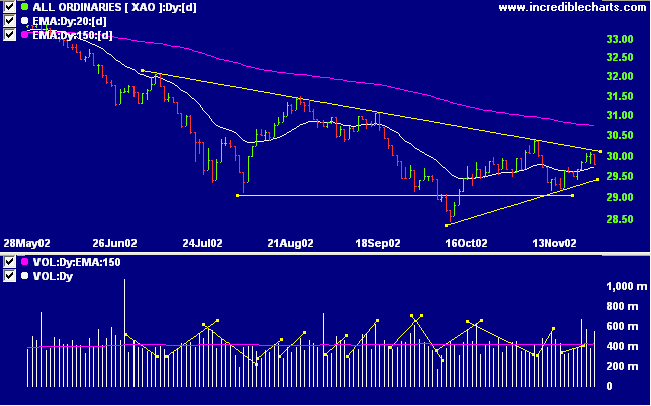

The primary trend will reverse if the index rises above 3150.

The MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs money flow is falling.

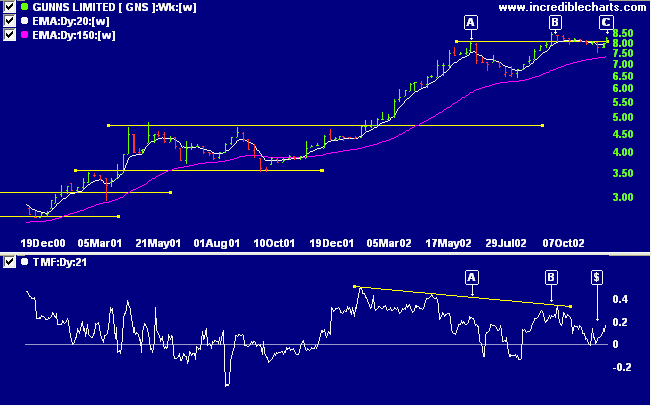

After a strong stage 2 up-trend GNS formed a bearish divergence on Twiggs money flow and MACD at [A] before a correction back to the 150-day MA. Price then rallied to a marginal new high at [B] before drifting lower to [C]. Twiggs money flow has made a bullish trough above the zero line [$], while MACD and Relative strength (price ratio: xao) are rising.

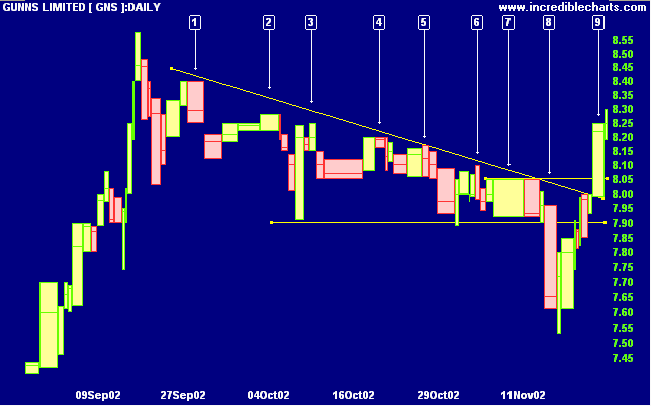

This could well be a bear trap. A correction that fails to break below 8.05 will be a strong bull signal.

It is important to do the right things right.

- Peter Drucker

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.