To contact another member, click on their link in the left margin. In the Profile page you will find:

Trading Diary

November 25, 2002

The primary trend will reverse (up) if the index rises above 9130.

The Nasdaq Composite Index held on to its gains, closing up 0.9% at 1481.

The primary trend is up.

The S&P 500 an inside day, closing 2 points up at 932.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 46% (November 22).

Newscorp may make a second attempt to take over DirecTV after EchoStar's bid encounters difficulties.

Gold

New York: Spot gold is down 290 cents at $US 317.70.

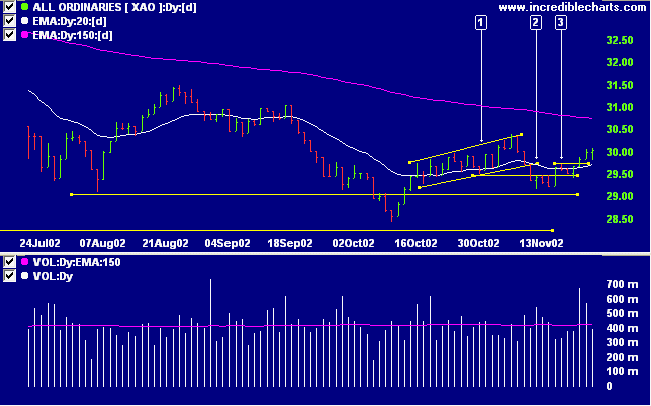

The primary trend will reverse if the index rises above 3150.

The MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs money flow signals accumulation.

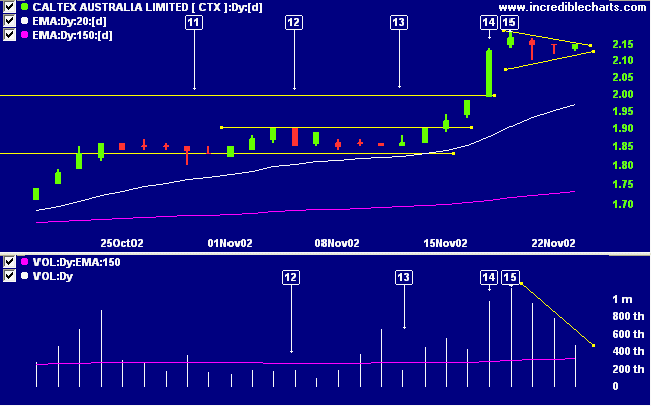

Last covered on November 19, 2002.

After breaking through resistance at 2.00, CTX has failed to pull back to the support level, forming a bullish pennant pattern instead. The continuation pattern is reinforced by the sharp increase in volume, [14] and [15], at the start of the pattern, followed by declining volume. An upward breakout accompanied by a sharp increase in volume will be a strong bull signal. Stop losses are normally placed below the lower border of the pattern, opposite the breakout.

Relative strength (price ratio: xao), Twiggs money flow and MACD are all bullish.

A break below the lower border of the pattern would be bearish.

I'd suggest that you take the time to seriously ponder

whether the path you are on is the one you want to be on.

Perhaps your journey will then be shortened.

- Jack Schwager's conclusion to The New Market Wizards

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.