To contact another member, click on their link in the left margin. In the Profile page you will find:

Trading Diary

November 22, 2002

Understanding the Trading Diary provides further guidance.

The primary trend will reverse (up) if the index rises above 9130.

On the 21st the Nasdaq Composite Index completed a primary trend reversal on strong volume. The index closed almost unchanged today at 1468.

The S&P 500 closed 3 points down at 930.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 44% (November 21).

PC makers face a bleak Christmas. (more)

Gold

New York: Spot gold is up 340 cents at $US 320.60.

The primary trend will reverse if the index rises above 3150.

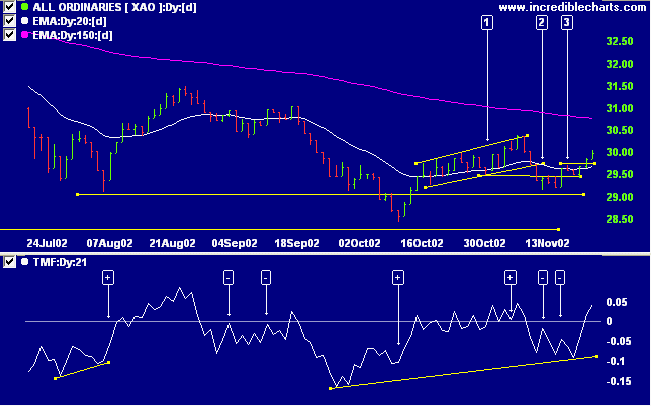

The MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines; Twiggs money flow signals accumulation.

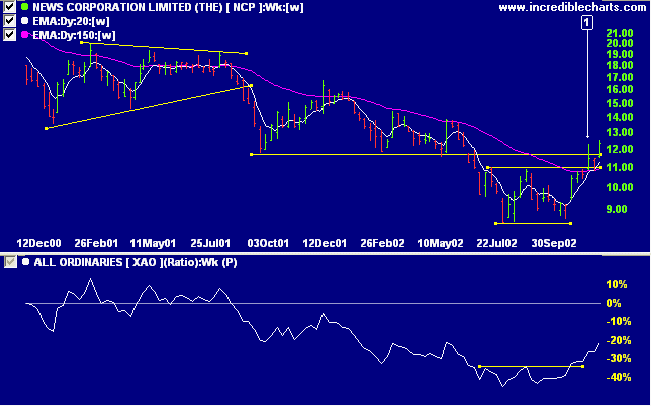

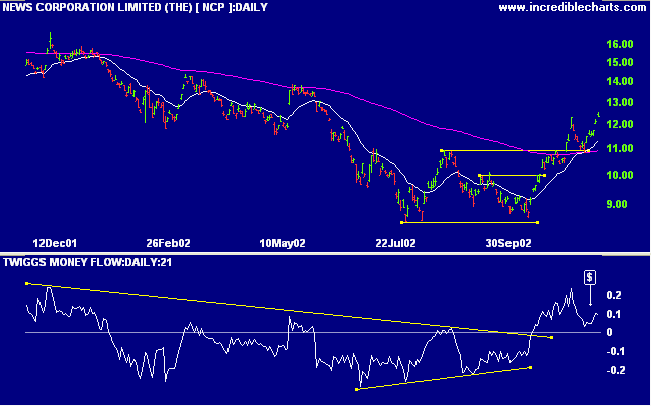

Last covered on November 14, 2002.

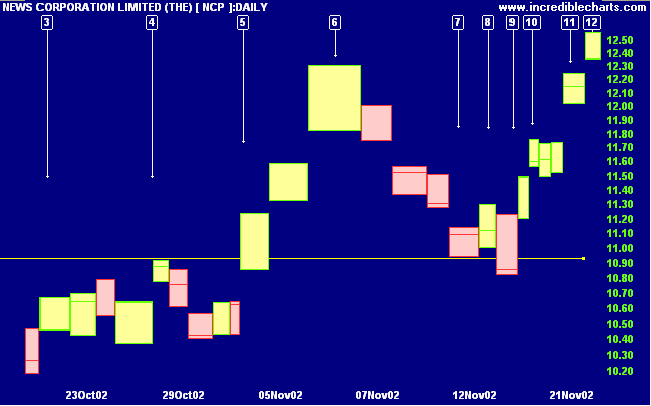

NCP formed a double bottom reversal, completed at [1]. This was followed by a pull-back to test the new support level and then a second rally.

The bar at [12] displays a long shadow, signaling weakness, and the stock may well pull back to re-test the 10.92 support level.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 4 (RS is falling)

- Health Care [XHJ] - stage 1 (RS is level)

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 30 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Diversified Metals & Mining

- Construction Materials

- Casinos & Gaming

- Highways & Railtracks

- Gold

- REITs

I believe in love even when I cannot feel it.

- written on a wall at Auschwitz concentration camp

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.