We request that individuals employed in the broking, financial planning, investment management or share trading (including software and training) industry, disclose their interest when posting to the Chart Forum. Disclosure can be made in the Members Profile or on the actual posting. Failure to disclose will be viewed as a deliberate attempt to mislead members and will incur an advertising charge at penalty rates.

Our aim is to protect members from market professionals who recommend products or services, or talk up stocks, without disclosing their interest.

Trading Diary

November 20, 2002

Understanding the Trading Diary provides further guidance.

The primary trend will reverse (up) if the index rises above 9130.

The Nasdaq Composite Index rallied 3.2% to close at 1419, again testing resistance.

The primary trend will reverse (up) if the index breaks above 1426.

The S&P 500 gained 18 points to close at 914.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 42% (November 19).

HP announce fourth-quarter earnings of 24 cents per share, 2 cents above expectations. (more)

Gold

New York: Spot gold is down 110 cents at $US 317.30.

The primary trend will reverse if the index rises above 3150.

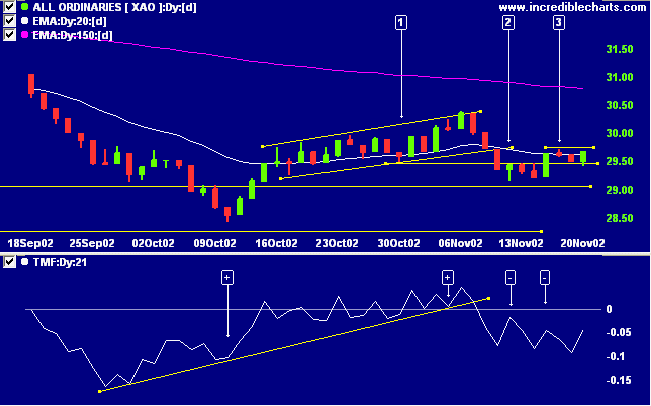

The Slow Stochastic (20,3,3) is above its signal line, MACD (26,12,9) is below, while Twiggs money flow signals distribution.

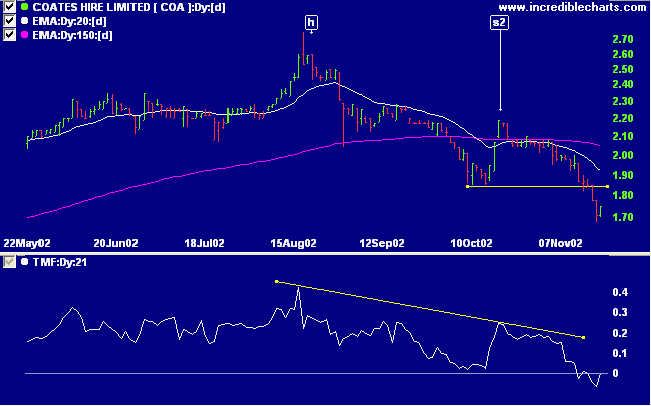

Last covered on October 23.

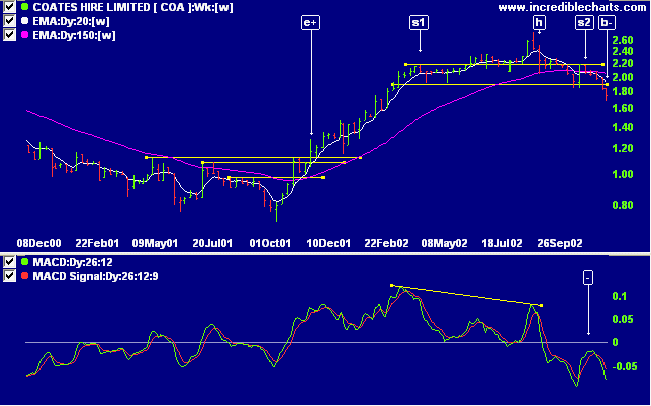

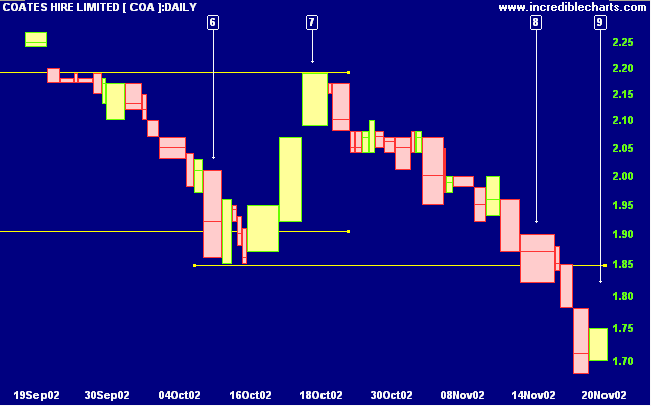

COA completed a head and shoulders pattern after a stage 2 up-trend, with the head at [h] and shoulders at [s1] and [s2]. Relative strength (price ratio: xao) is falling and MACD has completed a strong bear signal [-] after a bearish divergence.

and the upside will take care of itself.

- Donald Trump: The Art of the Deal

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.