We request that individuals employed in the broking, financial planning, investment management or share trading (including software and training) industry, disclose their interest when posting to the Chart Forum. Failure to disclose will be viewed as a deliberate attempt to mislead members and will incur an advertising charge at penalty rates.

Our aim is to protect members from market professionals who recommend products or services, or talk up stocks, without disclosing their interest.

Trading Diary

November 18, 2002

Understanding the Trading Diary provides further guidance.

The primary trend will reverse (up) if the index rises above 9130.

The Nasdaq Composite Index again tested resistance at 1426 before closing 1.2% down at 1393.

The primary trend will reverse (up) if the index breaks above 1426.

The S&P 500 imitated the Dow, closing 9 points down at 900.

The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 40% (November 15).

Weapons inspectors arrive in Baghdad. The crunch comes on December 8, when Iraq has to hand over a declaration of its weapons program. (more)

Gold

New York: Spot gold is down 110 cents at $US 319.20.

The primary trend will reverse if the index rises above 3150.

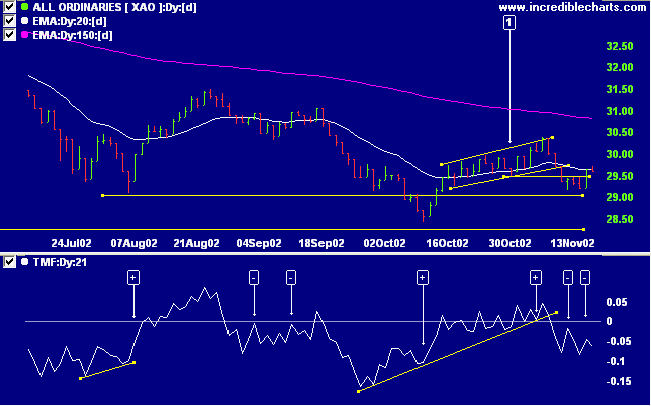

The Slow Stochastic (20,3,3) is above its signal line, MACD (26,12,9) is below, while Twiggs money flow signals distribution.

Last covered on October 17.

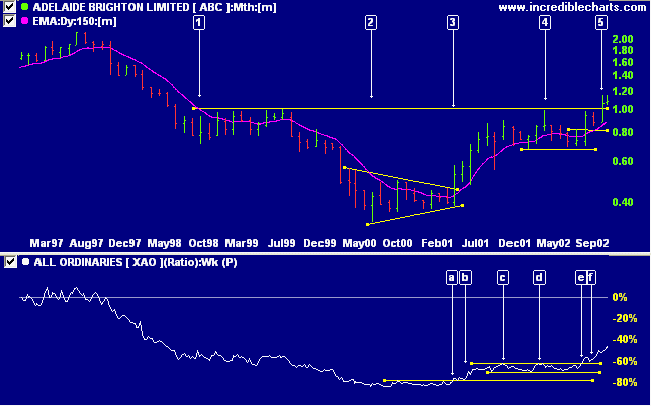

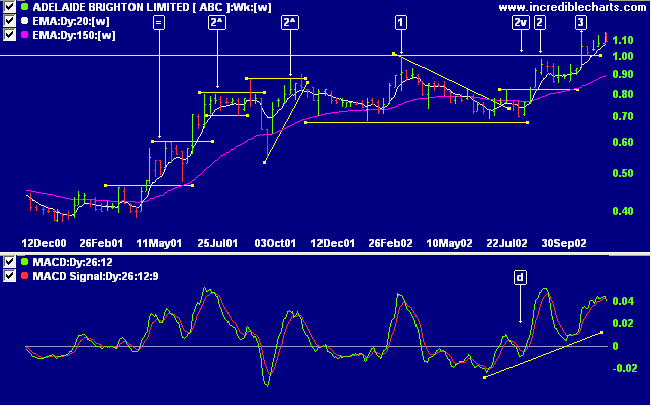

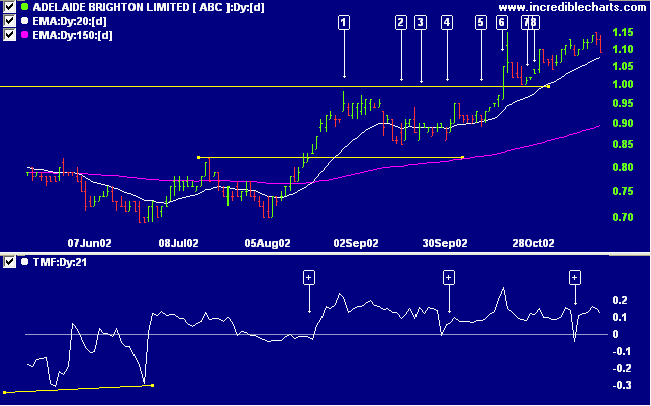

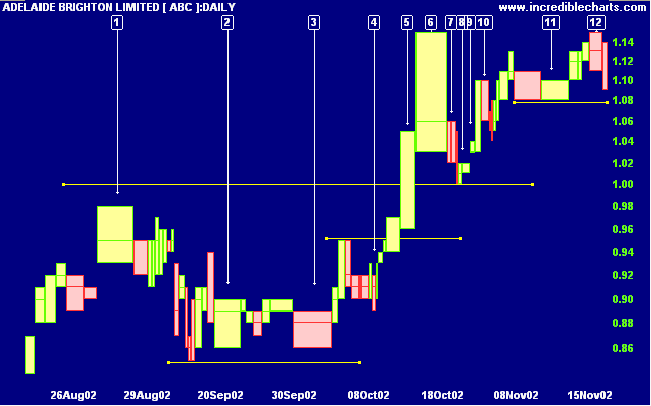

ABC has completed an inverted head and shoulders on the monthly chart: the left shoulder at [1], the head in the form of a triangle at [2] to [3], the right shoulder at [4], and the break through the neckline at [5]. The target for the pattern is 1.67 ( 1.00 + 1.00 - 0.33). Relative strength (price ratio: xao) started to rise [a] at the breakout from the bottom triangle at [3] and was confirmed when the next trough [b] respected support. The indicator then moved sideways for an extended period, forming equal highs at [c] and [d], before again breaking out at [e] with confirmation at [f].

A rise above 1.15 will be bullish, while a pull-back which respects the 1.15 support level will be a strong bull signal. A break below 1.08 will be bearish and may signal a re-test of support at 1.00.

than the unquestionable ability of man

to elevate his life by conscious endeavor.

- Henry David Thoreau

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.