We have activated a Spell Checker to assist members with their postings.

Please inform us if there are any obvious words (like "MACD") that we have failed to add to the dictionary.

Trading Diary

November 07, 2002

The Nasdaq Composite Index fell almost 3% to 1377. The primary trend will reverse to up if the index breaks above 1426.

The S&P 500 lost 21 points to close at 902. The primary trend will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 40% (November 06).

The Internet equipment maker reported higher sales and earnings but warned of a worsening outlook for the next quarter. (more)

Gold

New York: Spot gold jumped 300 cents to $US 320.80.

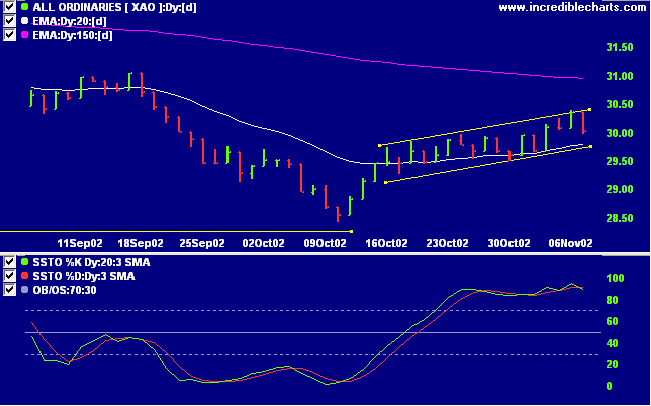

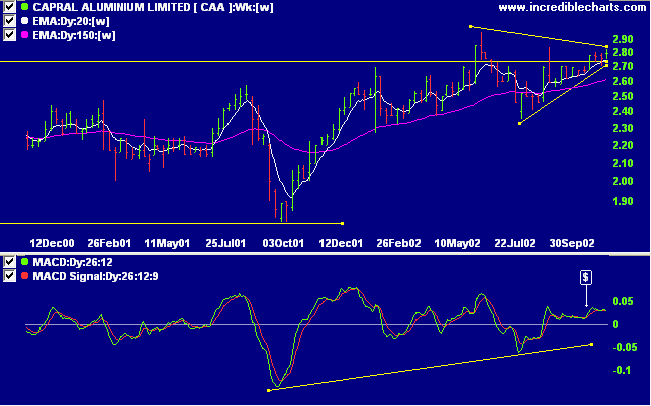

The Slow Stochastic (20,3,3) closed below its signal line, MACD (26,12,9) is above, while Twiggs money flow continues to signal accumulation.

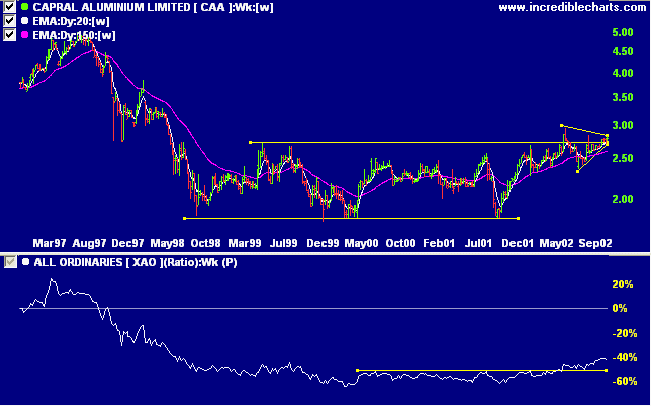

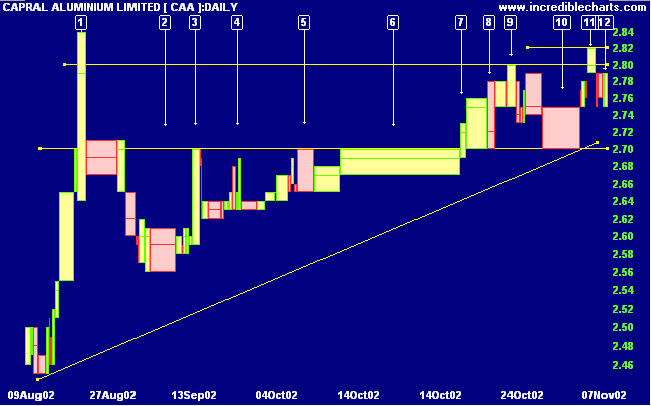

After reaching 5.00 in 1997 CAA entered a stage 4 down-trend followed by a broad stage 1 base. Price ranged between 1.80 and 2.70 for more than 4 years before failed breakouts in June and August 2002. The stock has now formed a bullish triangle pattern astride the upper boundary of the previous trading range: price is consolidating at this level rather than retreating back to support at 1.80. Relative strength (price ratio: xao) is rising.

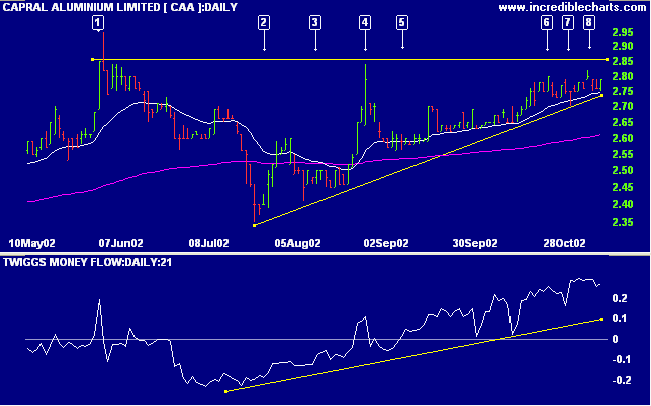

Twiggs money flow signals accumulation.

The spike at [1] encountered resistance at 2.84 and retreated to [2]. Then several equal highs formed at [3], [4] and [5], as CAA encountered resistance at 2.70, before broad volume at [6] overcame selling pressure, producing a breakout on day [7]. Subsequent corrections at [8] and [10] have respected the new support level, with buying support signaled by the long shadow at [10].

The break above resistance at 2.80 failed to hold, but the ensuing 3 day counter-trend is on weak volume.

Short-term traders may be setting buy-stops above 2.80, to pick up the resumption of the up-trend, with their stop-loss one or two ticks below the low of [12]. Those who prefer to taker a longer view will wait for stronger signals.

A break above 2.85 will be a bullish signal, while a fall below 2.70 would be bearish.

- William Saroyan.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.