The next version of Incredible Charts will enable users to screen their own watchlists.

Trading Diary

October 31, 2002

The Nasdaq Composite Index tested upper resistance before closing back at 1329. The primary trend will reverse if the index breaks above 1426.

The S&P 500 is also ranging, closing 5 points down at 885. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 36% (October 30).

The US Commerce department report that GDP has grown by an annualized 3.1% in the third-quarter, compared to 1.3% in the last quarter, but lower than the expected 3.6%. (more)

The Chicago division of National Association of Purchasing Management index fell to 45.9 from 48.1 last month.

New York: Spot gold was up 200 cents at $US 317.90.

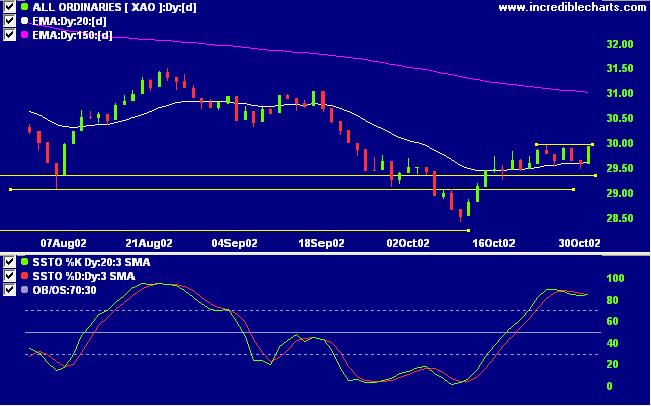

The Slow Stochastic (20,3,3) has crossed back above its signal line, MACD is above, while Twiggs money whipsaws around the zero line.

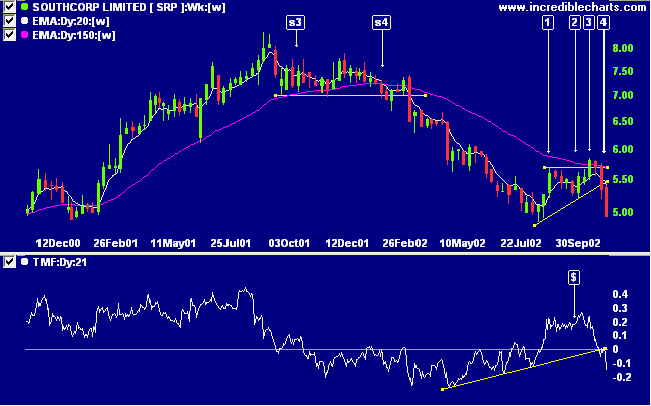

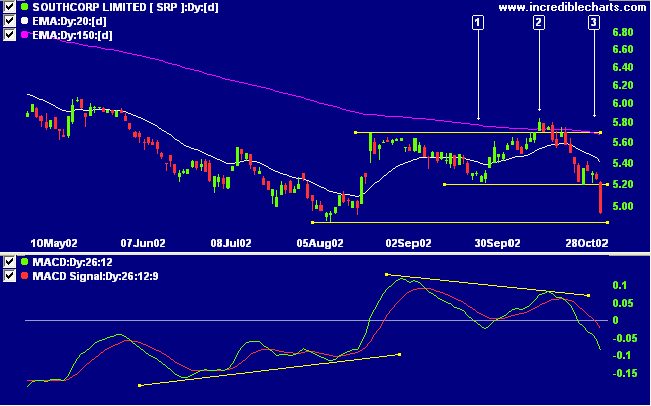

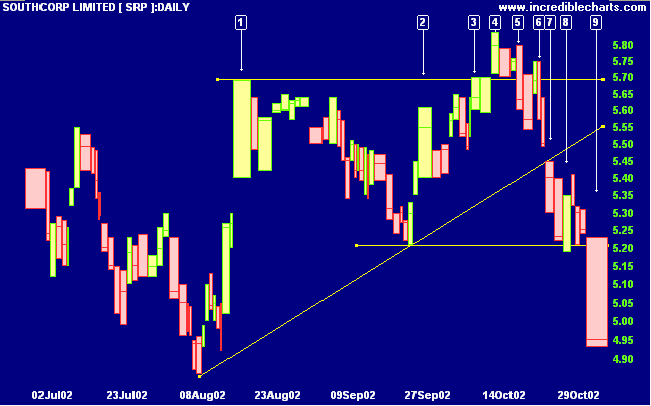

Last covered on August 20, 2002.

Here is a pattern worth storing in the memory for future reference. After a lengthy stage 4 down-trend SRP rallied to form a bullish ascending triangle pattern, completed by a breakout at [3]. This quickly reversed into a bull trap with a break below the base of the triangle. Twiggs money flow, after initial bull signals, has fallen sharply to signal distribution.

Jack Schwager maintains that failed signals are "among the most reliable of all chart signals" (Schwager on Futures: Technical Analysis).

Many intelligence reports in war are contradictory; even more are false, and most are uncertain.

Claus von Clausewitz (1831), On War.

We now know how securities analysts were employed in the 19th century.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.