Some development work is being done in this area and today users may experience the temporary loss of one or two filters.

Trading Diary

October 28, 2002

The Nasdaq Composite Index lost 16 points to close at 1315. The primary trend will reverse if there is a break above 1426.

The S&P 500 eased 7 points to close at 890. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 36% (October 25).

Concerns that the US recovery is faltering may convince the Fed to lower interest rates. (more)

Gold

New York: Spot gold is up 220 cents at $US 315.30. The gold chart has been forming a bullish ascending triangle over the last 6 months.

The Slow Stochastic (20,3,3) has crossed to below its signal line. MACD is above, while Twiggs money whipsaws around the zero line.

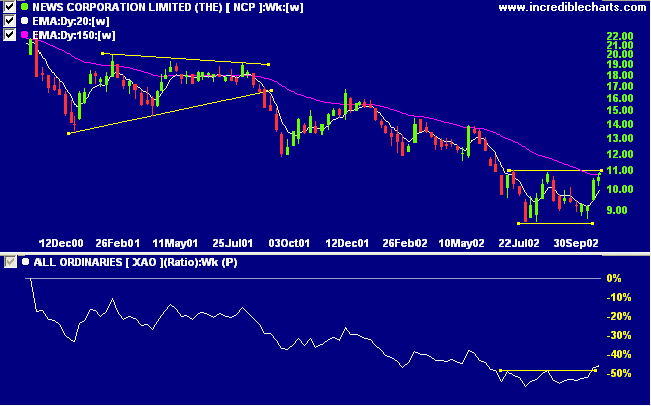

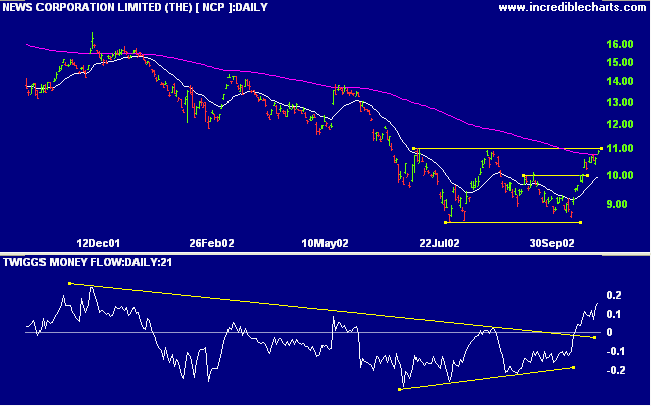

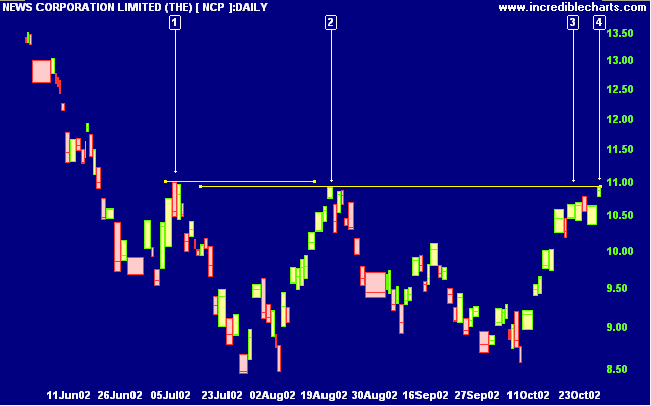

After a stage 4 down-trend NCP has formed 2 equal bottoms in the past 6 months. Relative strength (price ratio: xao) has signaled a trend change with a higher trough and break above the last peak.

Action without thought is like shooting without aim

- Old proverb.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.