We still have to find a solution to the registration email -

the registration hyperlink is sometimes severed if it wraps over 2 lines.

Trading Diary

October 25, 2002

The Nasdaq Composite Index rallied 2.5% to close at the previous day's high of 1331. The primary trend will reverse if there is a break above 1426.

The S&P 500 rallied 15 points to close at 897. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 36% (October 24).

Some of the biggest gainers in the last 2 weeks have been companies in the worst affected sectors. (more)

Gold

New York: Spot gold is up 180 cents at $US 313.10.

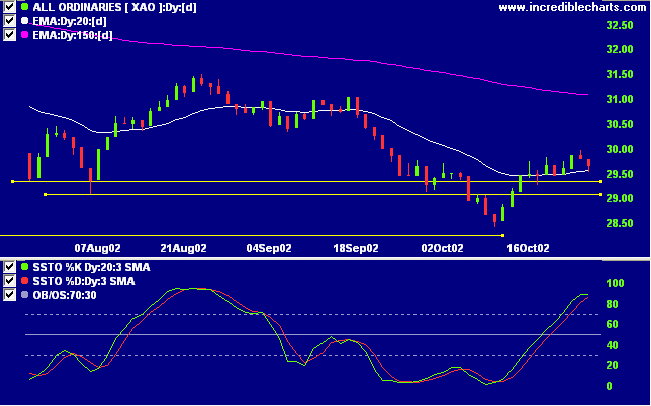

The Slow Stochastic (20,3,3) threatens to cross below its signal line. MACD shows a bullish divergence while Twiggs money continues to whipsaw around the zero line.

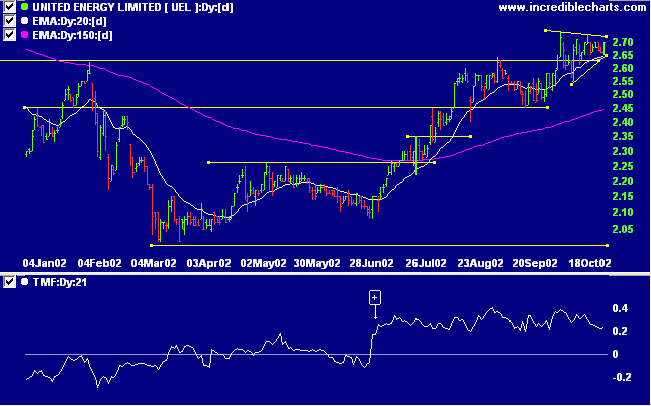

Last covered on August 2.

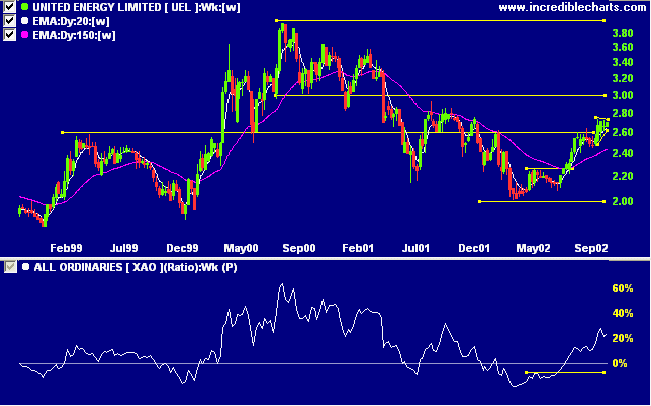

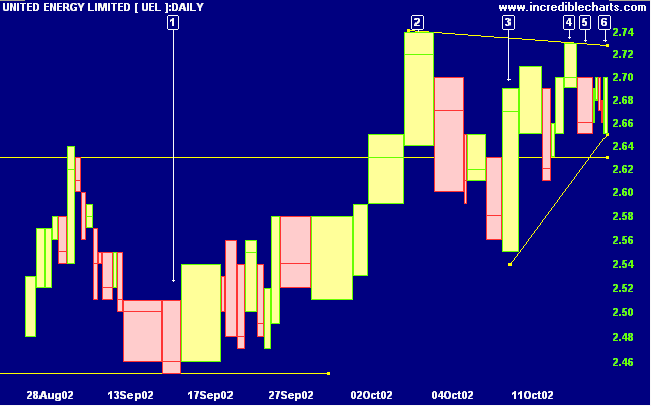

After a stage 2 down-trend UEL signaled a reversal with a higher trough followed by a break above the previous high, in July 2002. Relative strength (price ratio: xao) signaled the reversal with a similar upward break above the previous high.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is level)

- Materials [XMJ] - stage 1 (RS is level)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 4 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 33 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Diversified Metals & Mining

- Pharmaceuticals

- Health Care Distributors & Services

- Real Estate Investment Trusts.

I am certainly convinced of this: that it is better to be impetuous than cautious, because Fortune is a woman.....

And it is seen that she more often allows herself to be taken over by men who are impetuous than by those who make cold advances.....

- Niccolo Machiavelli, The Prince (1513).

With apologies to the ladies. NM's entire point is that Fortune favors those who may normally be cautious, but act boldly when required.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.