All chart legends can now be abbreviated.

Select Abbreviate Legend on the Format Charts menu.

This feature is especially useful when printing or emailing charts.

Trading Diary

October 24, 2002

The Nasdaq Composite Index lost 1.6% to close at 1298. The primary trend will reverse if there is a break above 1426.

The S&P 500 eased 14 points to close at 882. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 34% (October 23).

The online retailer reached operating break-even in the third-quarter on a 33% rise in revenues over a year earlier. (more)

Gold

New York: Spot gold is down 30 cents at $US 311.30.

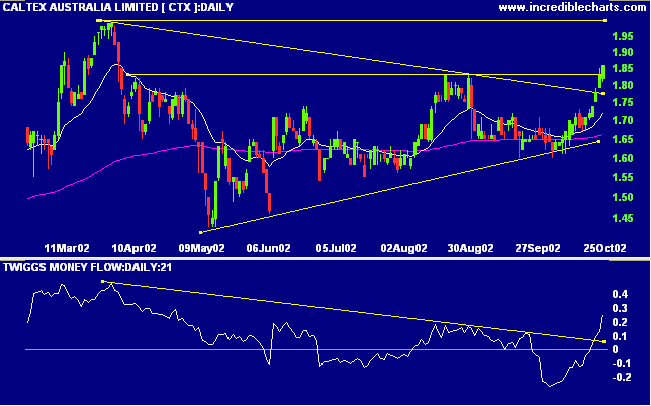

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. MACD shows a bullish divergence while Twiggs money continues to whipsaw around the zero line.

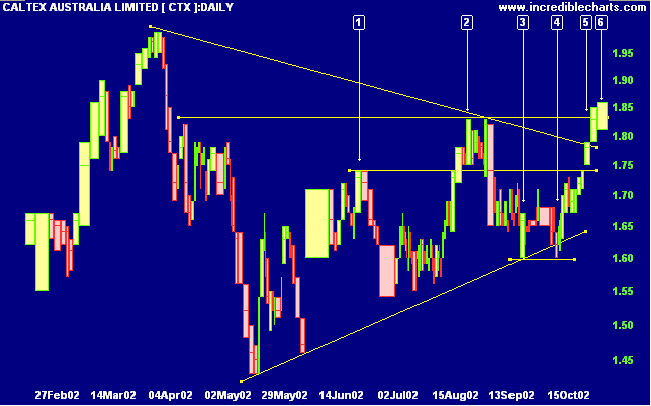

The target objective for the triangle pattern is 2.39 (1.78 + 1.99 - 1.38), measured vertically from the base of the triangle to the highest peak and then projected up from the breakout point (1.78).

Win or lose, everybody gets what they want out of the market.

Some people seem to like to lose, so they win by losing money.

- Ed Seykota, from Market Wizards by Jack Schwager.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.