Some readers have encountered difficulties registering for the new Chart Forum.

The emailed hyperlink is sometimes severed if it wraps over 2 lines.

HTML still has its idiosyncracies.......we are working on a solution.

Trading Diary

October 23, 2002

The Nasdaq Composite Index gained 2.2% to close at 1320. The primary trend will reverse if there is a break above 1426.

The S&P 500 edged up 6 points to close at 896. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator has swung to a bull alert signal at 34% (October 21).

The media giant is forced to restate earnings by $US 97 million over 2 years, because of overstatement of advertising revenue in its AOL division. (more)

Gold

New York: Spot gold was down 80 cents at $US 311.60.

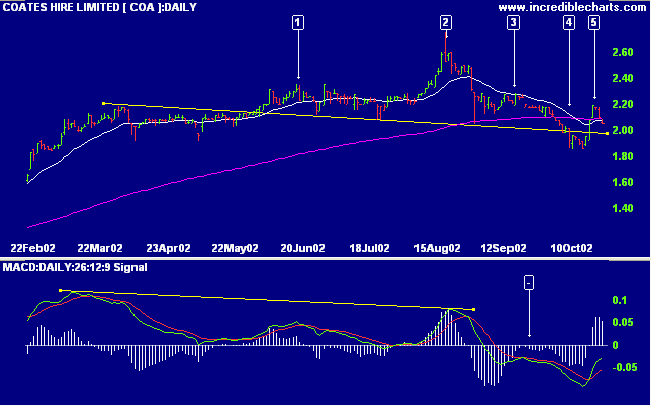

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. MACD shows a bullish divergence while Twiggs money signals accumulation.

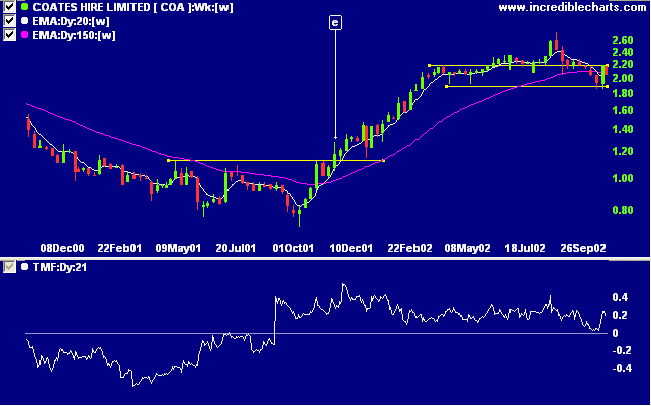

After presenting a favorable entry point at [e] COA rallied strongly before leveling off into a congestion pattern: either a top or a consolidation before a further rally. Twiggs money flow displays an impressive 12 months of accumulation, never once crossing below zero.

Stan's 9th Commandment:

Don't guess a bottom. What looks like a bargain can turn out to be a very expensive stage 4 disaster.

Instead, buy on breakouts above resistance.

- Stan Weinstein, Secrets for Profiting in Bull and Bear Markets.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.