The new version provides an option to abbreviate the chart legend, on the Format Charts menu.

Incredible Charts should automatically update when you login.

Use Help >>About to check that you have the latest version.

Trading Diary

October 21, 2002

The Nasdaq Composite Index climbed 1.7% to close at 1309. The primary trend will reverse if there is a break above 1426.

The S&P 500 is also forming a continuation flag, closing up 1.7% at 899. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 18).

Texas Instruments reported third-quarter earnings of 11 cents per share, compared to a loss of 3 cents a year ago, but warns that fourth-quarter sales and earnings will fall below estimates. (TI)

Dow component 3M Co. increased earnings by 38%, compared to the third quarter last year, and raised its guidance for the fourth quarter. (3M)

New York: Spot gold was down 190 cents at $US 310.60.

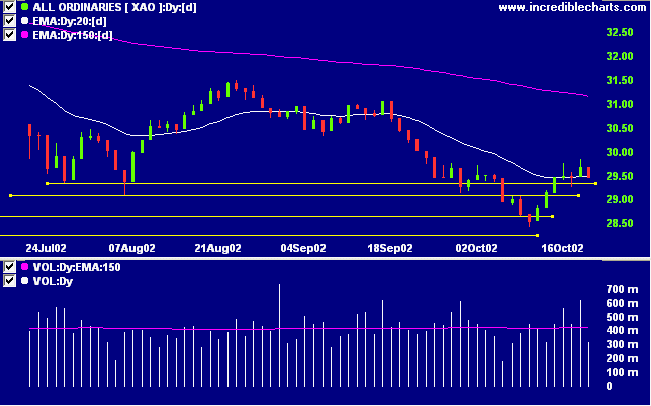

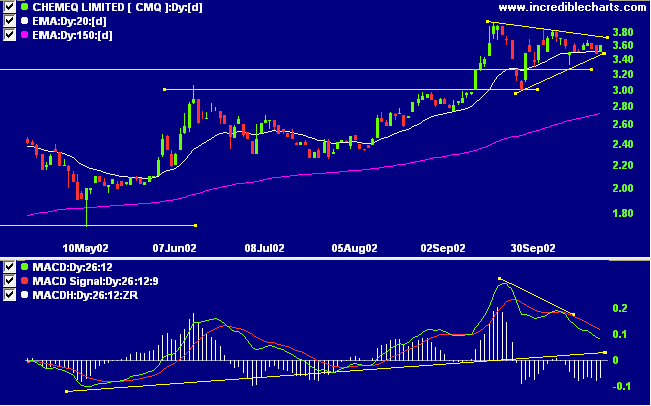

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. Twiggs money is whipsawing around the zero line after a bullish divergence.

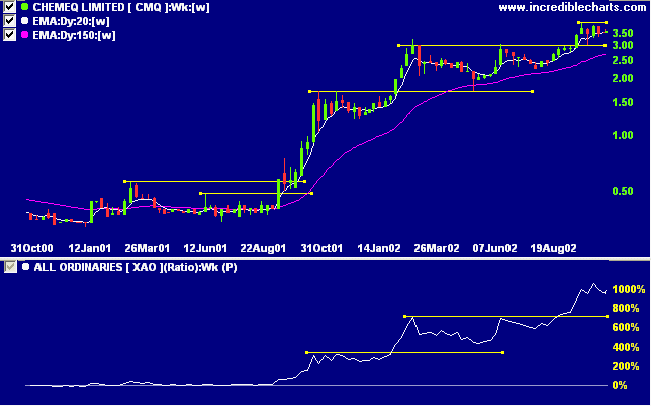

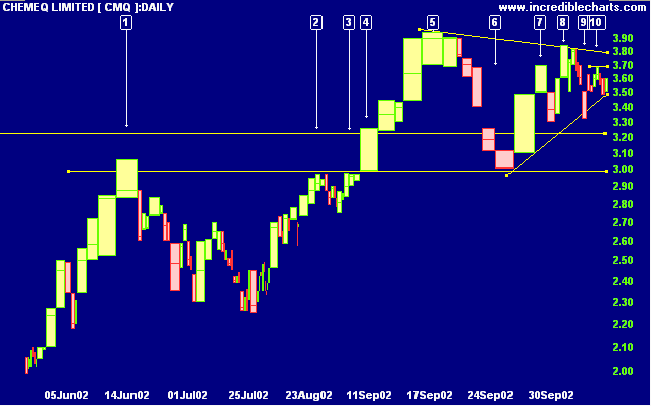

After a stage 2 up-trend CMQ broke through resistance at 3.00 and is now forming a pennant/symmetrical triangle between 3.00 and 4.00. Relative strength (price ratio: xao) continues to rise.

Many people watch, but few see.

- Monty Roberts, Horse Sense for People.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.