A new update will be released this weekend.

Use Help >>About to check that you have the latest version.

The Nasdaq Composite Index gained more than 1% to close at 1287. The primary trend will reverse if there is a break above 1426.

The S&P 500 gained 5 points to close at 884, forming a continuation flag. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 17).

Bond yields are rising sharply, with 10-year treasury notes up more than 0.5% from their 40-year low of 3.56% on October 9. (more)

New York: Spot gold was up slightly at $US 312.50.

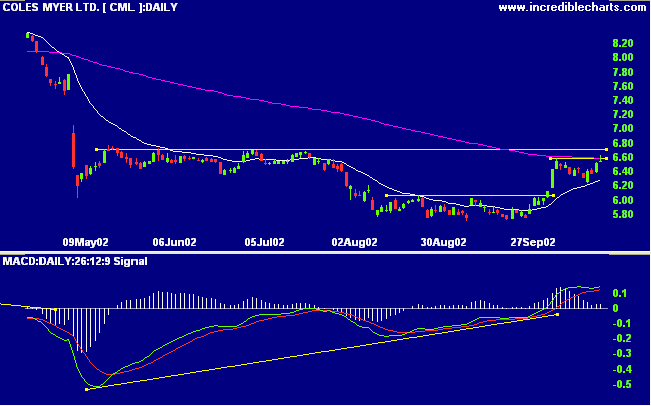

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. Twiggs money signals accumulation, after a bullish divergence.

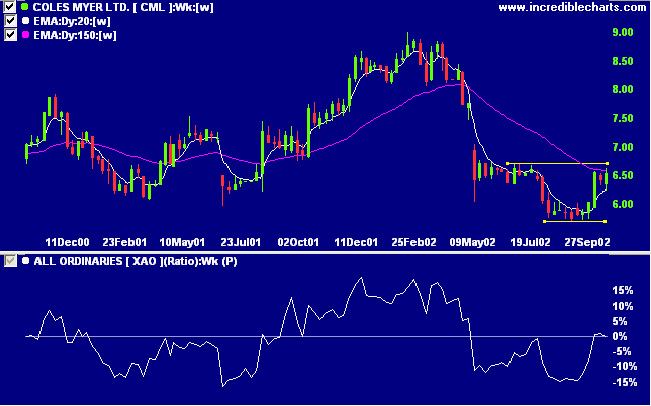

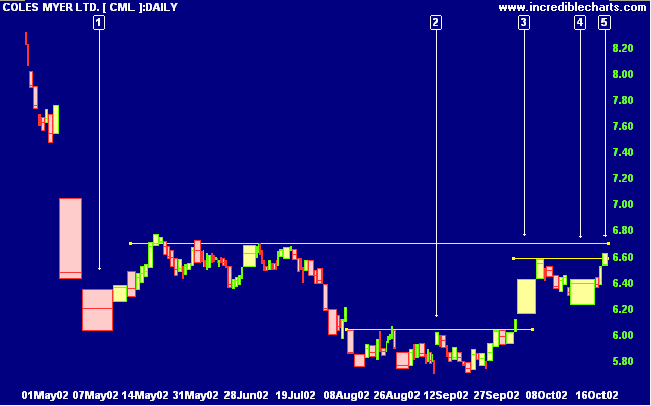

CML formed a U-shaped bottom, normally referred to as a rounded bottom or saucer pattern, after a stage 4 down-trend. One reader pointed out that the pattern resembles a cup and handle pattern - these tend to be unreliable if a stock is trending downwards. Relative strength (price ratio: xao) shows a slight improvement.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 25 stocks (compared to 99, August 23rd and 10 on October 4th).

If a speculator is correct half the time he is hitting a good average. Even being right three or four times out of ten

should yield a person a fortune if he has the sense to cut his losses quickly on the ventures where he has been wrong.

- Bernard Baruch

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.