If you have any suggestions as to how we can improve the charts, website or newsletter,

please post them at the Chart Forum: Suggestion Box.

Trading Diary

October 14, 2002

The Nasdaq Composite Index gained 10 points to close at 1220. The primary trend is down.

The S&P 500 gained 6 points to close at 841. Immediate resistance is at 855 and the index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 11).

The absence of a sell-off, after two strong up days. Some see this as a good sign for the next few weeks. (more)

New York: Spot gold last traded at $US 317.40, up 130 cents.

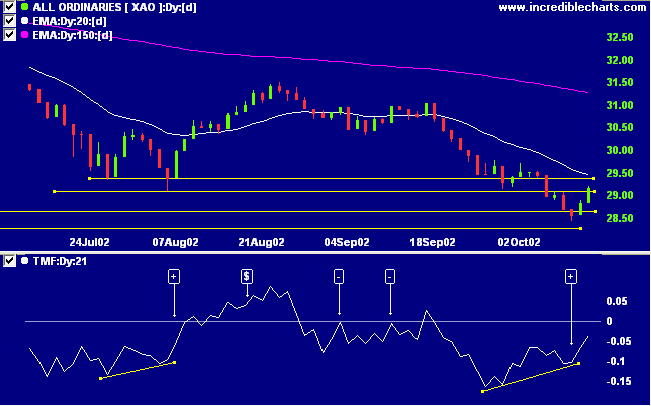

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below. Twiggs money flow signals a bullish divergence [+].

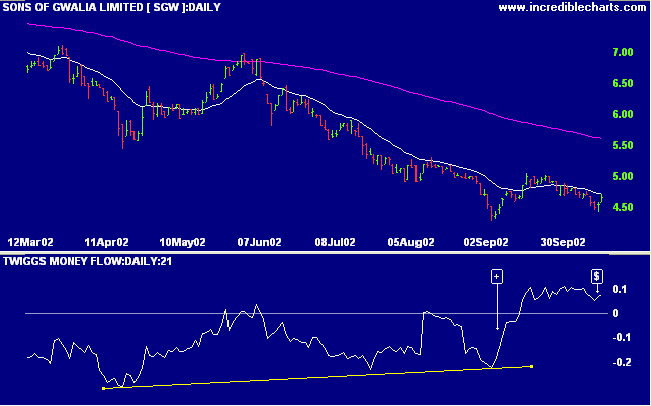

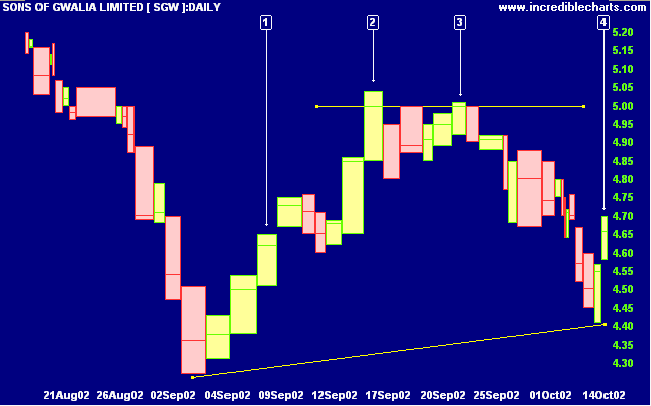

A lot has happened since September 2 when SGW was last covered.

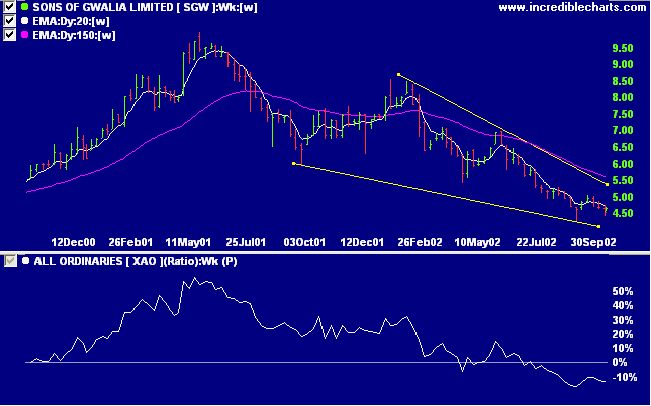

The stock has formed a bullish falling wedge while in a stage 4 down-trend. Relative strength (price ratio: xao) has been falling for the last 16 months but may be showing early signs of a reversal, forming a higher low.

Ordinary mortals know what's happening now,

the gods know what the future holds

because they are totally enlightened.

Wise men are aware of future things

just about to happen.

- C.P. Cavafy, a poem based on lines by Philostratos

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.