If you have any suggestions as to how we can improve the charts, website or newsletter,

please post them at the Chart Forum: Suggestion Box.

Trading Diary

October 11, 2002

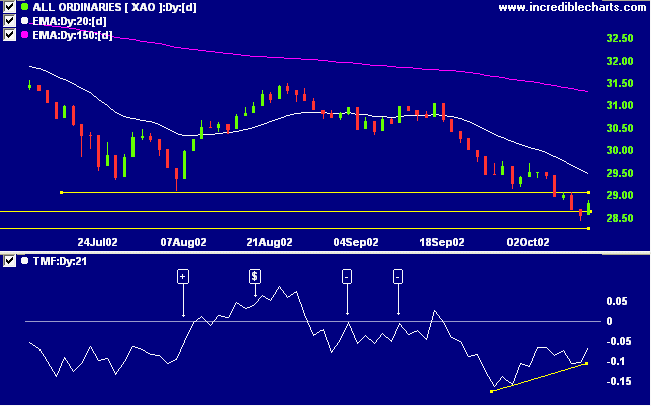

The primary trend is down.

The Nasdaq Composite Index gapped up at the open, closing 4.0% up at 1210. The primary trend is down.

The S&P 500 rose 32 points to close at 835. Resistance is at 855. A key level is 965 - the index will complete a double bottom if it rises above this level.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 10).

GE reported an 11% increase in third-quarter sales while profits increased 25%, boosted by the sale of their e-commerce unit. IBM climbed 11% after Lehman Brothers analyst Dan Niles upgraded his rating, predicting that IBM sales will recover next year. (GE)(IBM)

The yield on 10-year treasury notes spiked up to 3.8%, off a low of 3.56%. (more)

New York: The spot gold price closed down 30 cents at $US 316.10.

Slow Stochastic (20,3,3) has crossed to above its signal line; MACD (26,12,9) is below. Twiggs money signals a bullish divergence.

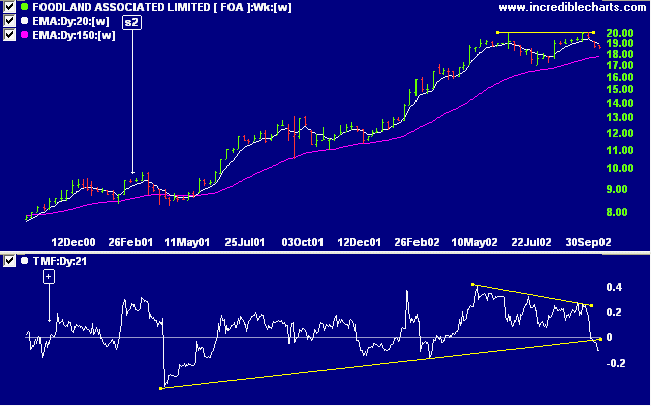

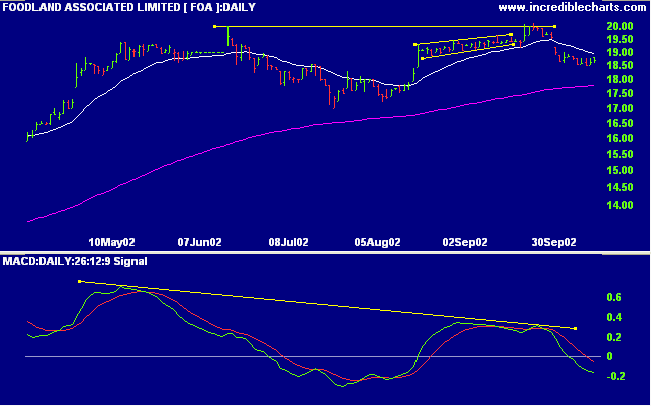

Last covered on September 16.

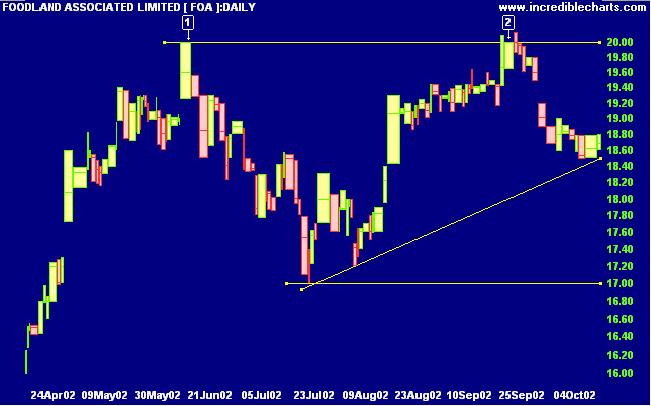

Foodland has formed two equal highs at 20.00 while in a stage 2 up-trend. Relative strength (price ratio: xao) and the 150-day moving average are still rising but Twiggs money flow shows a bearish divergence and has broken below its 18-month trendline.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 4 (RS is falling)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returns 11 stocks (compared to 99, August 23rd and 10 on October 4th).

One of the most helpful things that anybody can learn is to give up trying to catch the last eighth - or the first.

These two are the most expensive eighths in the world.

- Edwin Lefevre, Reminiscences of a Stock Operator (1923)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.