If you have any suggestions as to how we can improve the charts, website or newsletter,

please post them at the Chart Forum: Suggestion Box.

Trading Diary

October 10, 2002

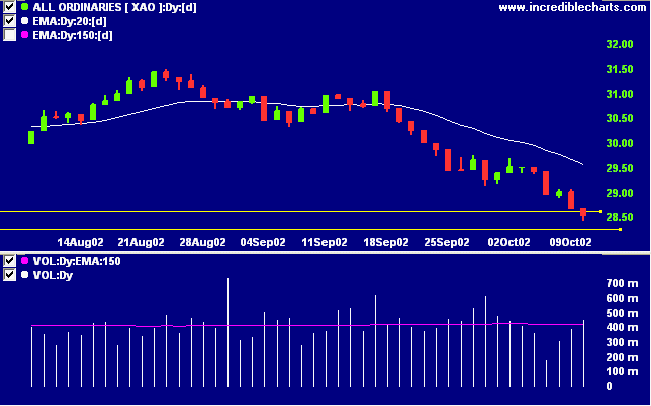

The primary trend is down.

The Nasdaq Composite Index rallied strongly, gaining 4.4% to close at 1163. The next major support level is 1000, from 1996. The primary trend is down.

The S&P 500 also formed a key reversal, rising 3.5% to close at 803.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 9).

States received 384,000 applications for unemployment benefits last week, down 10% on the week before. (more)

The U.S. House of Representatives voted 296-133, giving President George W. Bush the power to go to war against Iraq. (more)

New York: The spot gold price dropped sharply, down 330 cents at $US 316.40.

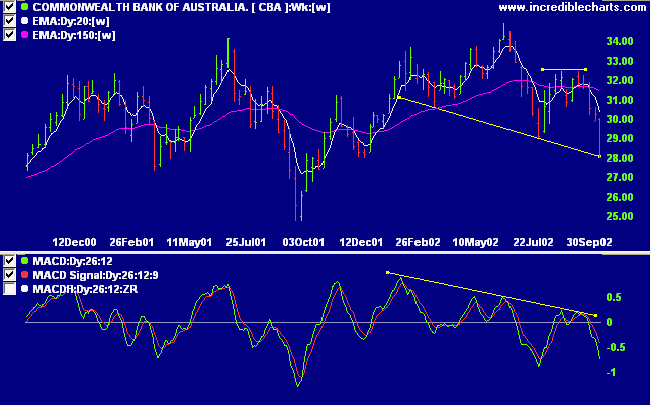

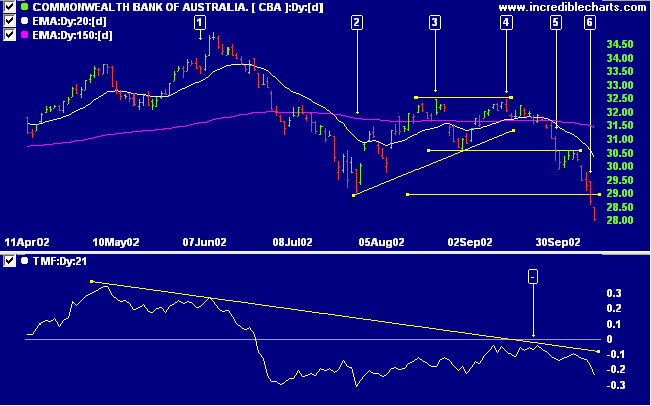

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines. Twiggs money flow signals distribution.

Last covered on August 21, CBA has since formed a head and shoulders reversal pattern after a stage 2 up-trend.

Relative strength (price ratio: xao) has broken its upward trend and is falling. MACD shows a bearish divergence.

I never argue with the tape.

- Edwin Lefevre, Reminiscences of a Stock Operator (1923)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.