Use Help >>About to check that you have the latest update. The new version offers:

-

A Price

Ratio (relative strength) indicator that applies to all

securities in a project.

When installing on the Indicator Panel, select "Apply to Project".

-

New Stock Screens

- Directional Movement (+DI, -DI and ADX)

- MACD above or below zero

- Volume Filter

- Equivolume with closing prices

Trading Diary

October 09, 2002

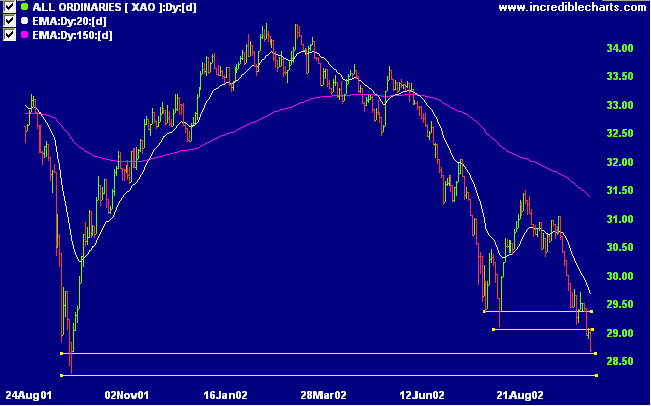

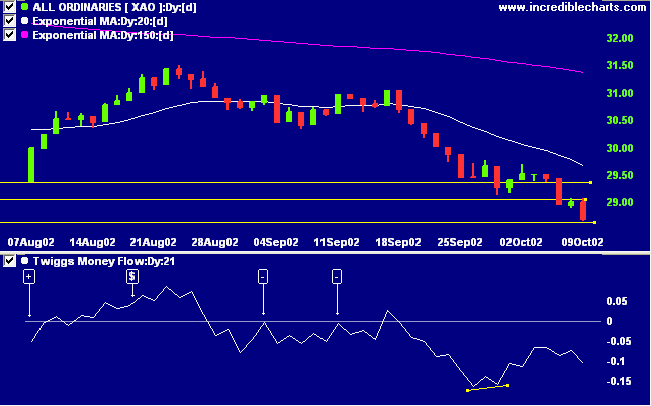

The primary trend is down.

The Nasdaq Composite Index is already below 1997 levels and appears set to test the 1000 support level from 1996. The index closed down 15 points at 1114. The primary trend is down.

The S&P 500 recorded a 2.7% drop to close at 776, still above the 1997 low of 729.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 28% (October 8).

Investors sell General Electric and auto-makers Ford and GM, on concerns over earnings. Financial stocks are also down as pessimism abounds. (more)

The internet stock reported a 50% increase in third-quarter revenue compared to last year and earnings per share of 5 cents, ahead of expectations. (more)

New York: The spot gold price has recovered slightly, up 160 cents at $US 319.70.

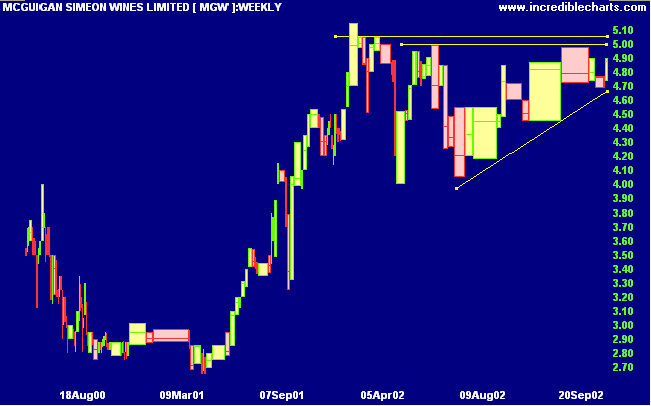

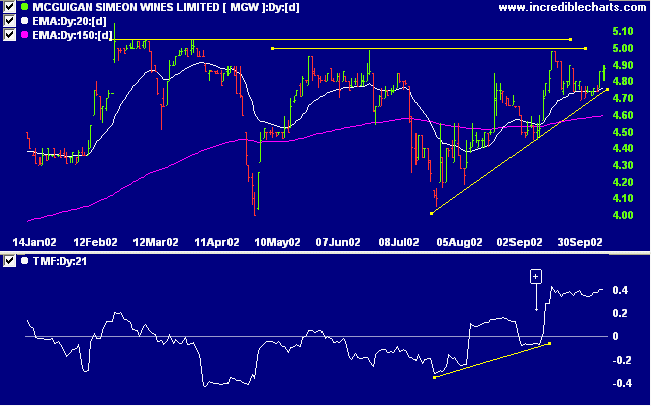

Last covered on September 18, MGW has formed an ascending triangle (some may interpret the pattern as a symmetrical triangle) after a stage 2 up-trend.

There are three things that you have to believe before you can trade successfully:

- You have to believe that it is actually possible to make money trading the markets.

- You have to believe that it is possible for you to make money trading the markets.

- You have to believe that you deserve to make money trading the markets.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.