Use Help >>About to check that you have the latest update. The new version offers:

-

A Price

Ratio (relative strength) indicator that applies to all

securities in a project.

When installing on the Indicator Panel, select "Apply to Project".

-

New Stock Screens

- Directional Movement (+DI, -DI and ADX)

- MACD above or below zero

- Volume Filter

- Equivolume with closing prices

Trading Diary

October 08, 2002

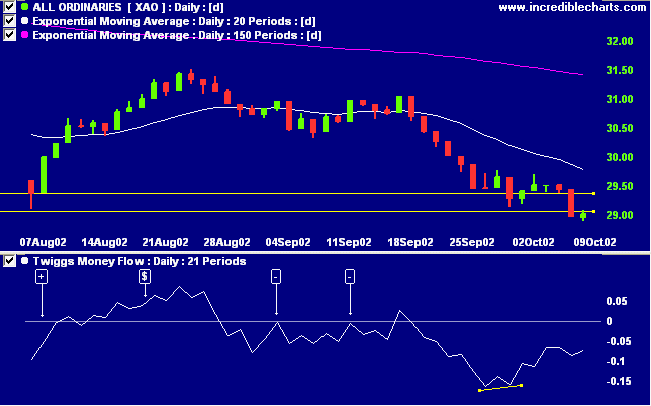

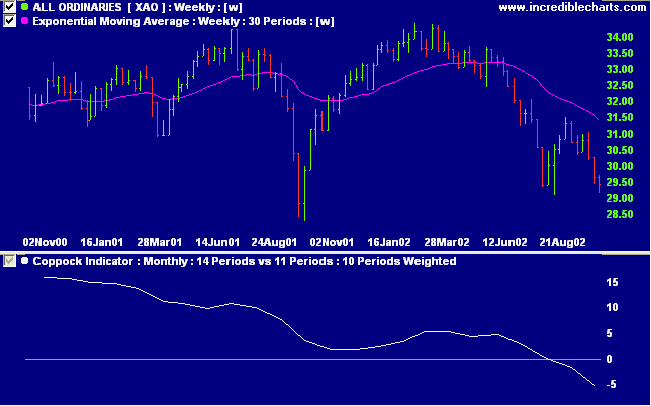

The primary trend is down.

The Nasdaq Composite Index rallied 10 points to close at 1129.

The primary trend is down.

The S&P 500 formed an outside day, closing up 11 points at 796.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 28% (October 7).

The markets were bouyed by the news that President Bush is seeking a court injunction to re-open West Coast ports. (more)

New York: The spot gold price declined 400 cents to $US 318.10.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines. Twiggs money flow is rising.

Thanks to Rocky who drew my attention to ADB on the chart forum and provided some of the following analysis.

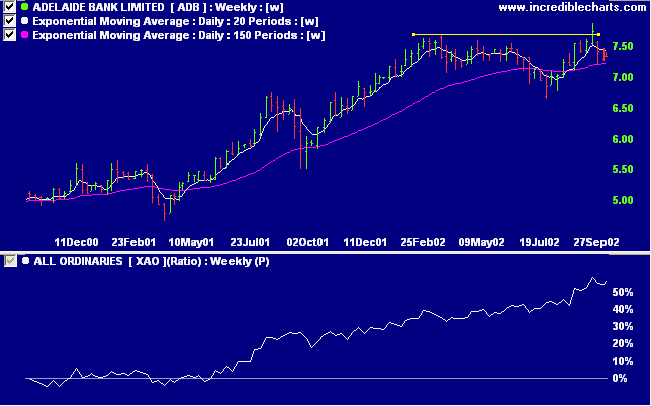

ADB is in a stage 2 up-trend with relative strength (price ratio: xao) rising.

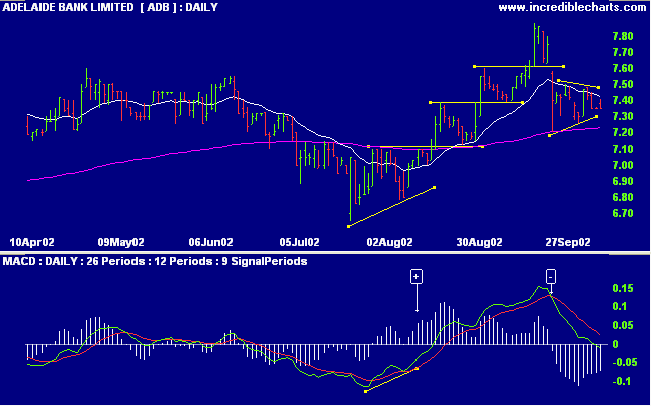

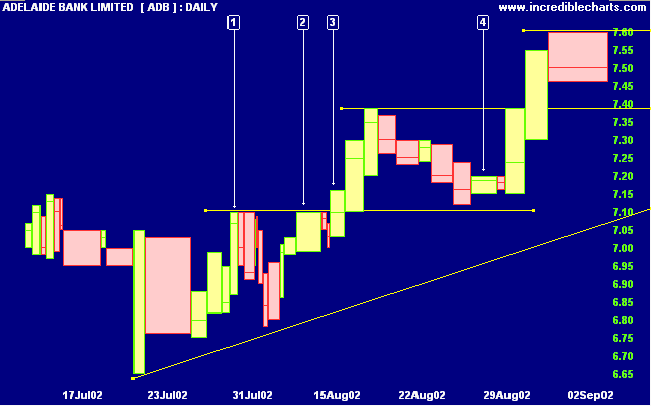

The chart for July-August shows the ascending triangle formed after 2 equal highs at [1] and [2]. The 2-day correction after [2] is on weak volume, followed by a buy signal at [3] when stock rallies above the resistance level. The ideal entry point would be a buy-stop just above resistance at 7.10 with a stop-loss a few ticks below (a stop at the bottom edge of the triangle would be too wide).

The next correction ends above the 7.10 resistance level, confirming a strong trend. Accumulation is shown by the wider bar at [4]; increase your position when price rallies above the high.

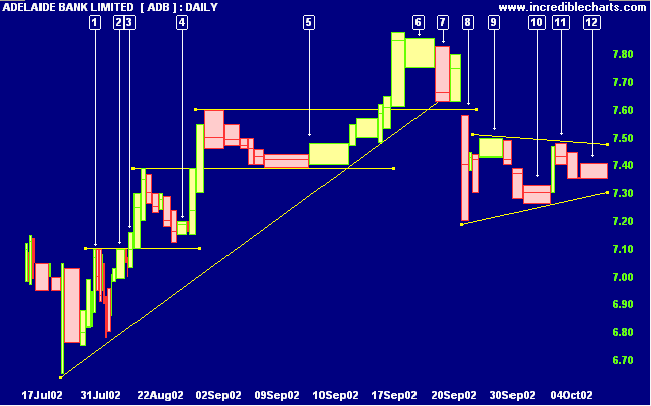

Distribution takes place at [6], near the new high. Take profits when price breaks below the low of [6], at [7]. Exit your remaining position when ADB gaps downward at [8].

Everyone has his own specific vocation or mission in life to carry out a concrete assignment which demands fulfillment. Therein he cannot be replaced, nor can his life be repeated. Thus, everyone's task is as unique as is his specific opportunity to implement it.

Victor Frankl - Man's Search for Meaning

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.