To be released this weekend, the new version offers:

-

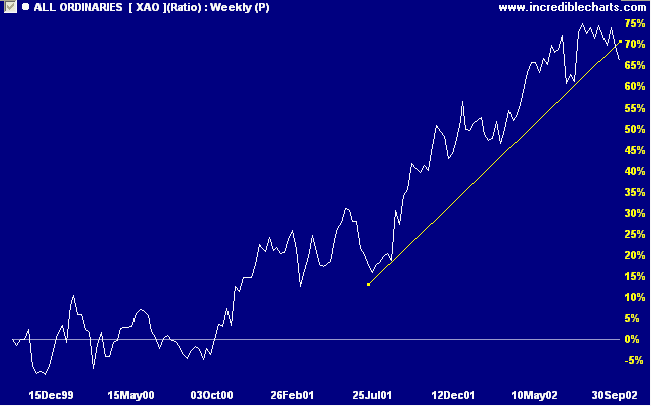

A Price Ratio (relative strength) indicator

that can apply to all securities in a project.

When installing on the Indicator Panel, select "Apply to Project".

-

New Stock Screens

- Directional Movement (+DI, -DI and ADX)

- MACD above or below zero

- Volume Filter

- Equivolume with closing prices

Trading Diary

October 04, 2002

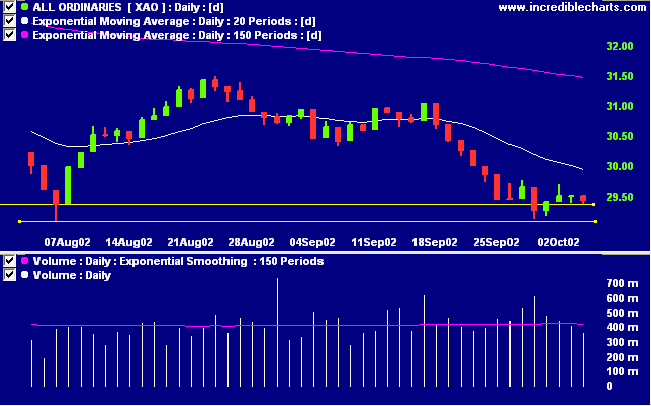

The primary trend is down.

The Nasdaq Composite Index, already well below 1998 lows, lost 2.2% to close at 1139.

The primary trend is down.

The S&P 500 closed 18 points down, at the 800 support level.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 32% (October 3).

A spate of earnings warnings, from drug maker Schering-Plough, Boeing and data storage specialist EMC, hammered market confidence.

A California court orders cigarette maker Philip Morris to pay $US 28 billion dollars in punitive damages, to a 64-year old woman with lung cancer. The size of the award may be reduced on appeal but will encourage further litigants.

New York: The spot gold price closed up 110 cents at $US 322.10.

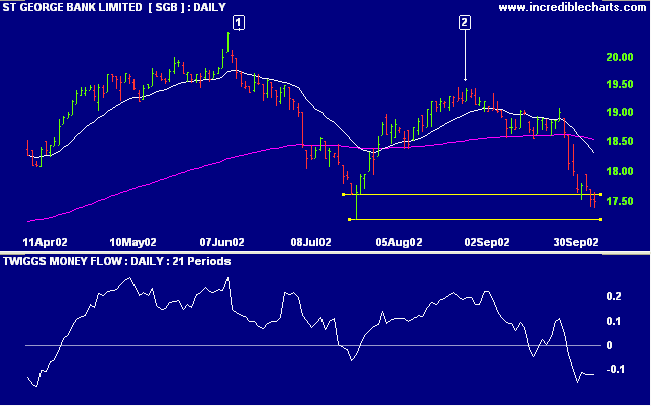

Slow Stochastic (20,3,3) is above its signal line, while MACD (26,12,9) is below. Twiggs money is still below zero.

The primary trend is down.

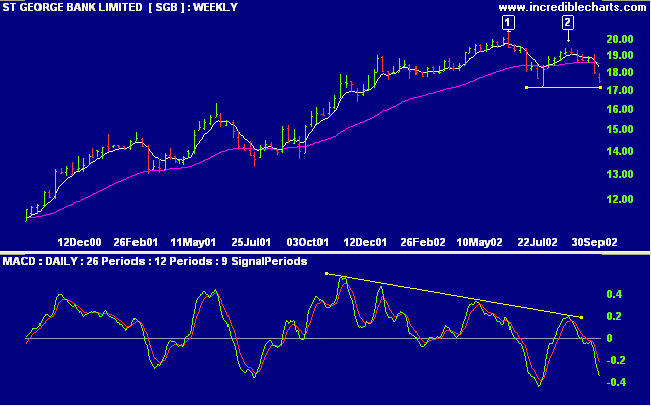

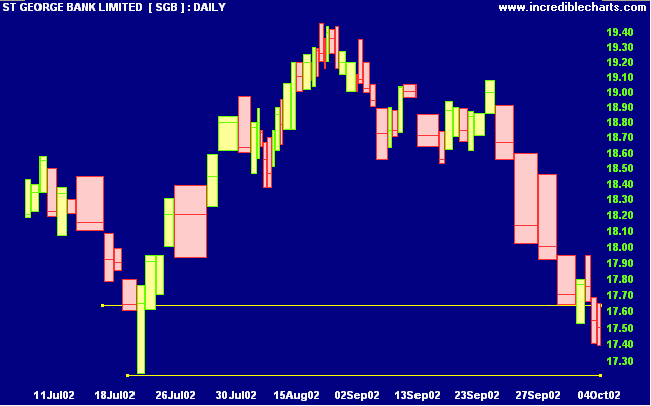

SGB has entered a stage 3 top, after a strong up-trend. The last peak at [2] is lower than the June 2002 high [1] of 20.47 and price appears set to test support at the intervening trough. A break below this level will signal a primary trend reversal (ie. commencement of a down-trend).

MACD displays a strong bearish divergence.

The shaded areas on the equivolume chart depict closing prices: the lighter shade is above the close in an up-trend, and below the close in a down-trend.

Changes are highlighted in bold.

- Energy [XEJ] - stage 1

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 4 (RS is falling)

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 3 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 1

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) is now down to 10 stocks, compared to 99 on August 23.

Notable sectors:

- Food Retail

The market is not like a balloon plunging hither and thither in the wind. As a whole, it represents a serious, well considered effort on the part of far-sighted and well-informed men to adjust prices to such values as exist or which are expected to exist in the not too remote future.

- SA Nelson

(Possibly analysts in 1903 were more far-sighted than they are today)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.