Registration is separate from the charting application - you can use a different username (and password if you wish).

The username uses only lowercase - no CAPITALS.

Only fields with an * are required fields. The rest are optional.

Trading Diary

October 02, 2002

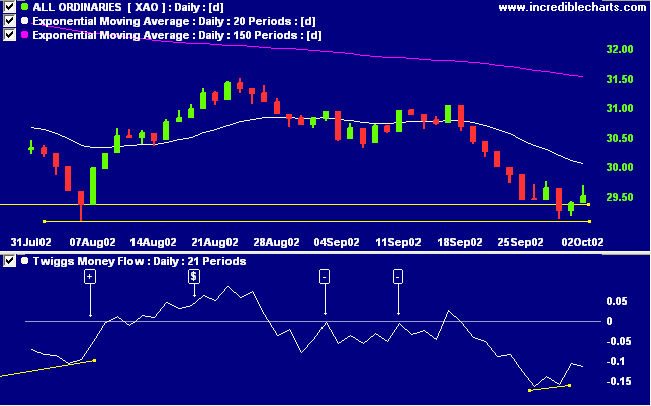

The primary trend is down.

The Nasdaq Composite Index fell 2.2% to close at 1187.

The primary trend is down.

The S&P 500 retreated by a similar amount, losing 20 points to close at 827.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 32% (October 1).

Dell raised its third-quarter sales and earnings guidance but the gains are at the expense of their competitors and do not signal a broad industry recovery. (more)

New York: The spot gold price recovered by 350 cents to $US 323.10.

The Slow Stochastic (20,3,3) is above its signal line, while MACD (26,12,9) is below. Twiggs money shows a small bullish divergence.

The primary trend is down.

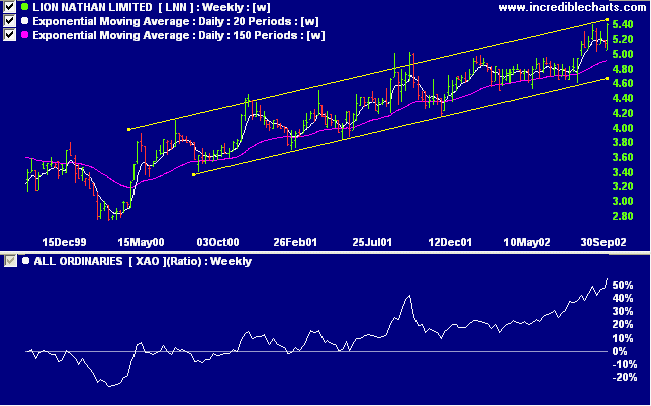

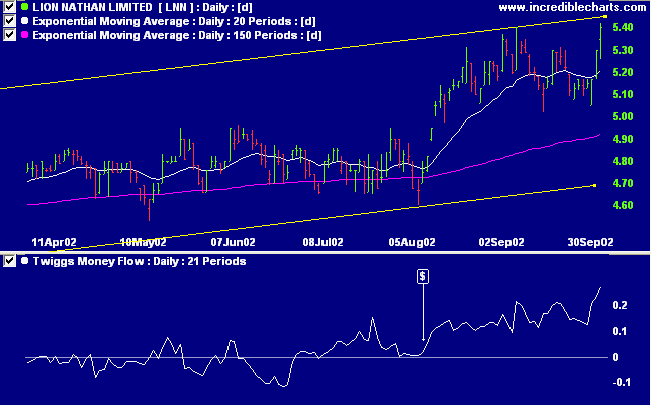

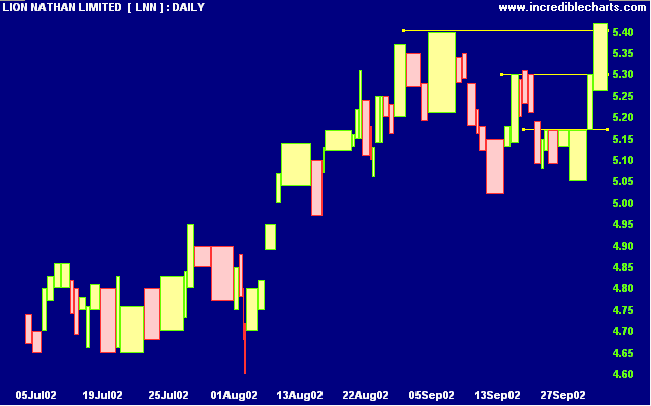

LNN made a new high, continuing its strong stage 2 up-trend. Relative strength (price ratio: xao) is rising.

A trader gets to play the game as the professional billiard player does

- that is, he looks far ahead instead of considering the particular shot before him.

It gets to be an instinct to play for position.

- Edwin Lefevre

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.