Registration is separate from the chart application - you can use a different username (and password if you wish).

The username uses only lowercase - no CAPITALS.

Only fields with an * are required fields. The rest are optional.

Trading Diary

October 01, 2002

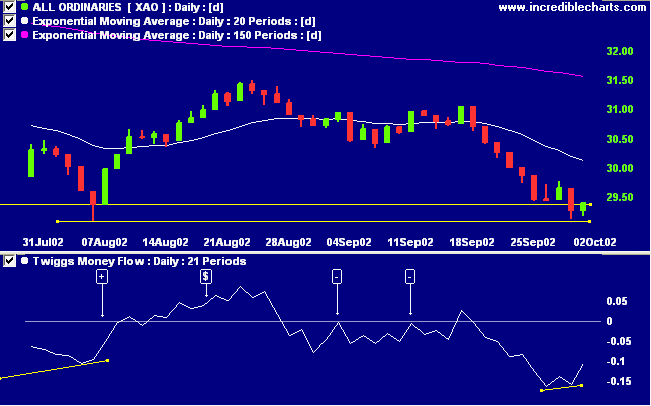

The primary cycle trends down.

The Nasdaq Composite Index gained 3.6% to close at 1213.

The primary trend is down.

The S&P 500 recovered 32 points to close at 847.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 32% (September 30).

The Dow jumped 347 points after news that weapons inspectors could return to Iraq within 2 weeks. But the US is insisting on a new UN security council resolution before their return. (more)

New York: The spot gold price lost 420 cents to $US 319.60.

The Slow Stochastic (20,3,3) is above its signal line, while MACD (26,12,9) is below. Twiggs money shows a small bullish divergence.

The primary trend is down.

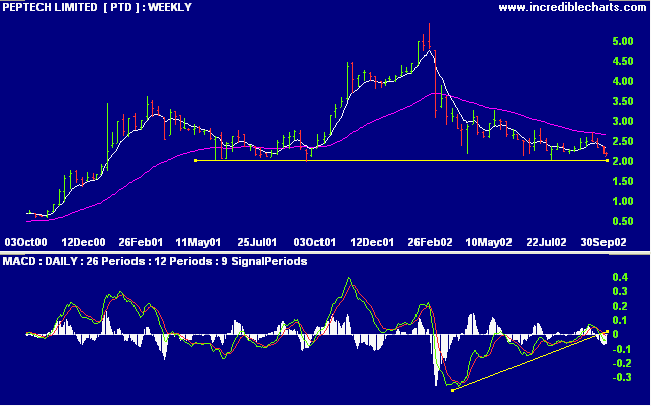

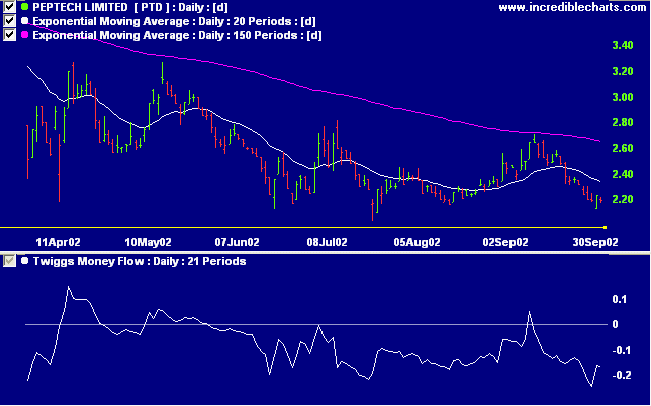

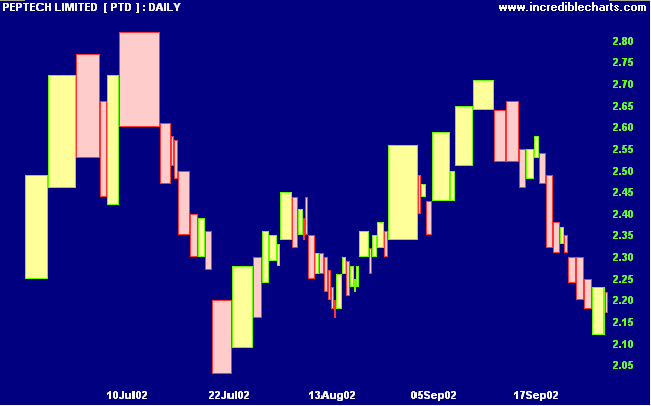

This biotech stock has been in a stage 4 down-trend for the past 6 months, falling more than 50% from its February high. Price has held above the key 2.00 support level while MACD signaled a bullish divergence. MACD has now broken its upward trendline, signaling weakness. Relative strength (price ratio: xao) is falling.

The Master said: "Put me in the company of any two people at random

- they will invariably have something to teach me.

I can take their qualities as a model and their defects as a warning.

- The Analects of Confucius, 7.22

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.