Registration

Only fields with an * are required fields. The rest are optional.

The username uses only lowercase - no CAPITALS.

Logging in

Automatic Login is a time-saving feature that recognizes you when you visit the forum. If activated, there is no Login field displayed. Instead, you will see a message: "Logged in as username", in the forum header.

The auto login can be turned on/off under Profile.

Trading Diary

September 30, 2002

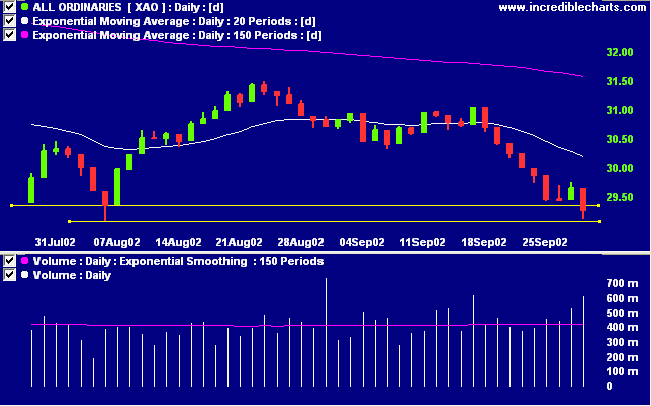

The primary cycle trends down.

The Nasdaq Composite Index closed down 2.3% at 1172.

The primary trend is down.

The S&P 500 lost 12 points to close at 815. Support is at 780 to 795.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 34% (September 27).

Two-year treasury bond yields are below the federal funds rate, implying further rate cuts. (more)

Wal-Mart led several retailers in lowering sales forecasts for the fall quarter.

Gold

New York: The spot gold price rallied to close 390 cents up at $US 323.80.

The Slow Stochastic (20,3,3) is above its signal line. Twiggs money flow signals distribution.

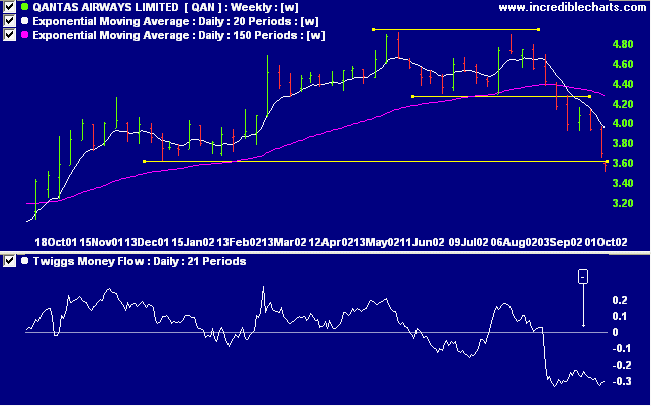

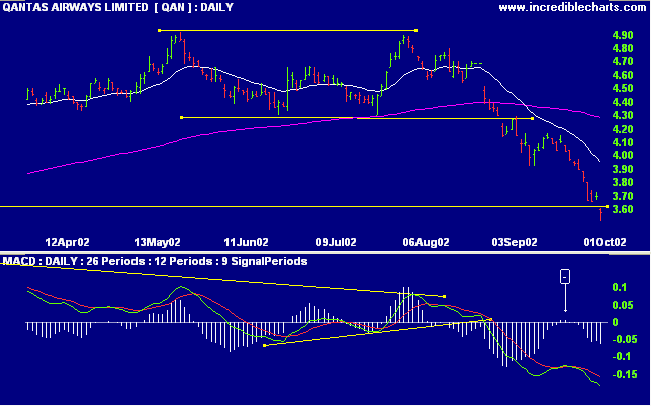

The primary trend is down.

Earlier in the year, the airline formed a double top with a target of 3.68, very close to the 3.65 - 3.62 support level from December 2001.

Price has now gapped below the support level while Twiggs money flow signals strong distribution.

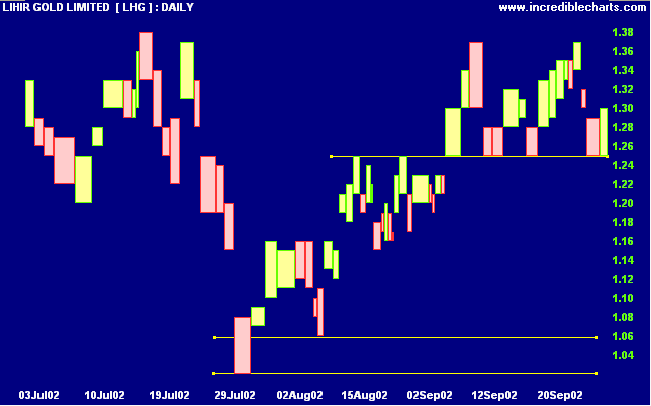

I mentioned in my last diary that LHG had broken down from an upward trend channel while Twiggs money flow had also broken a long term trendline. In response to a query on the chart forum: These signals are more of the "monitor closely" variety than a "strong sell". The stock is still holding above support at 1.25; a break below this would likely reach the 1.02 - 1.06 support level. But a rally above 1.37 would signal resumption of the up-trend.

I am yelling and screaming less because,

if I have an inkling that I might be on the wrong side of a stock, I just get out.

- Michael Freisen.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.