Registration

Only fields with an * are required fields. The rest are optional.

The username uses only lowercase - no CAPITALS.

Logging in

Automatic Login is a time-saving feature that recognizes you when you visit the forum. If activated, there is no Login field displayed. Instead, you will see a message: "Logged in as username", in the forum header.

The auto login can be turned on/off under Profile.

Trading Diary

September 26, 2002

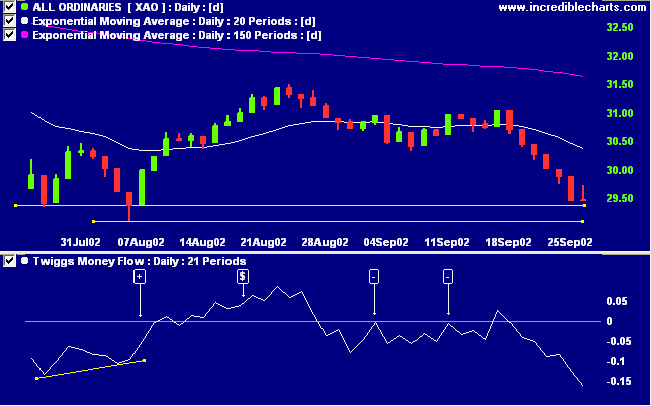

The primary cycle trends down.

The Nasdaq Composite Index rallied in morning trading but then weakened to close 1 point lower at 1221.

The primary trend is down.

The S&P 500 gained 15 points to close at 854.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 34% (September 25).

Jobless claims fell by 24,000 last week; the decline in durable goods orders was a lower than expected 0.6%; and home sales rose to a record 996,000 last month. (more)

New York: The spot gold price closed down 190 cents at $US 320.40.

The MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines. Twiggs money flow signals distribution.

The primary trend is down.

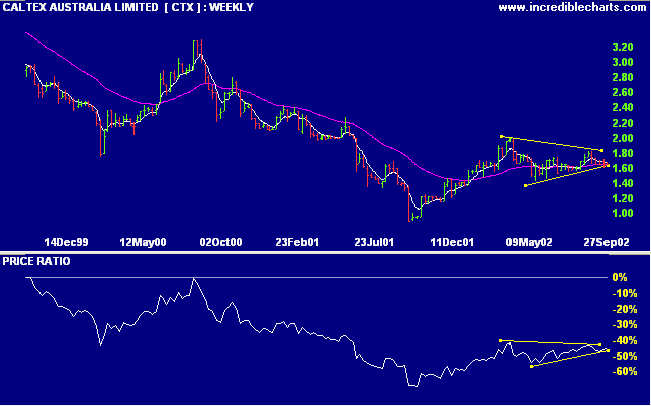

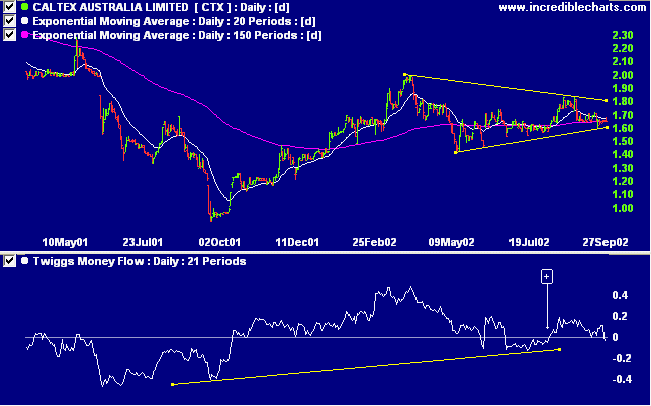

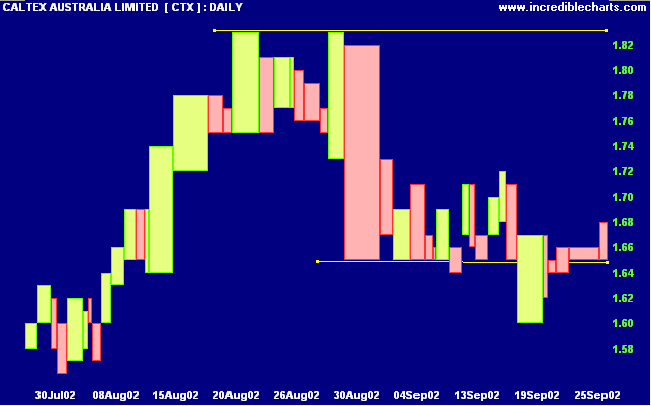

CTX has formed a stage 1 base after a lengthy down-trend. After rallying off a low of $0.90 the stock has formed a triangle congestion pattern; a bullish sign as the stock has not retreated back to support at 1.00. Wait for relative strength (price ratio: xao) to resume its upward rise.

We Japanese are obsessed with survival.

- Akio Morita, founder of Sony.

(We traders should also be obsessed with survival)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.