Registration

Only fields with an * are required fields. The rest are optional.

The username uses only lowercase - no CAPITALS.

Logging in

Automatic Login is a time-saving feature that recognizes you when you visit the forum. If activated, there is no Login field displayed. Instead, you will see a message: "Logged in as username", in the forum header.

The auto login can be turned on/off under Profile.

Trading Diary

September 25, 2002

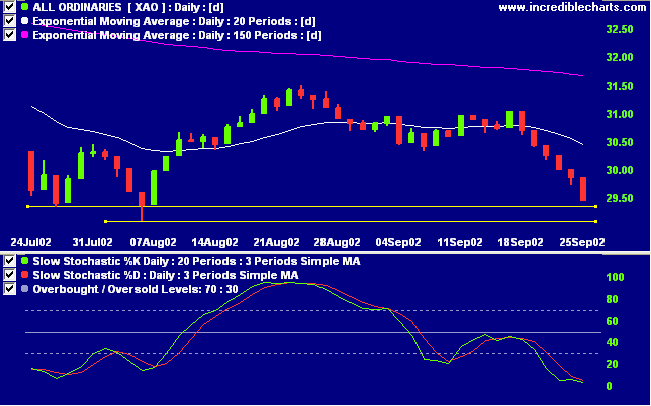

The primary cycle trends down.

The Nasdaq Composite Index rallied 3.4% to close at 1222.

The primary trend is down.

The S&P 500 gained 20 points to close at 839.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal, falling to 34% (September 24).

General Electric, the Dow's largest stock, says third-quarter profits may be up by as much as 25% on last year. (more)

New York: The spot gold price weakened, closing down 380 cents at $US 322.30.

The MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines. Twiggs money flow signals distribution.

The primary trend is down.

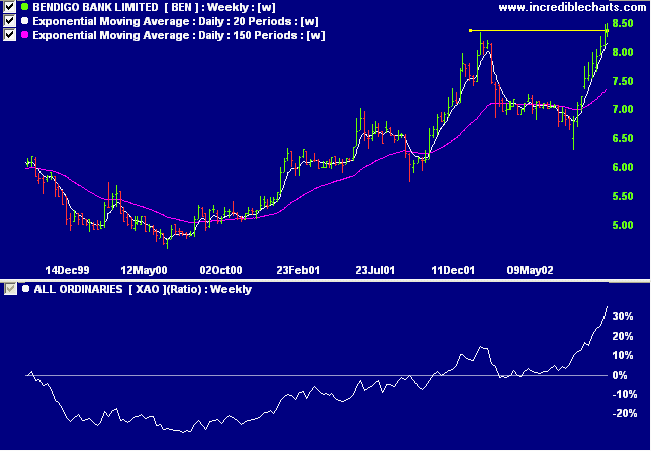

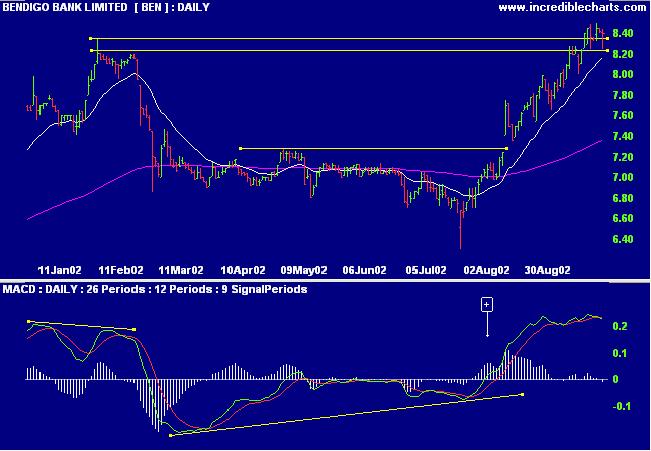

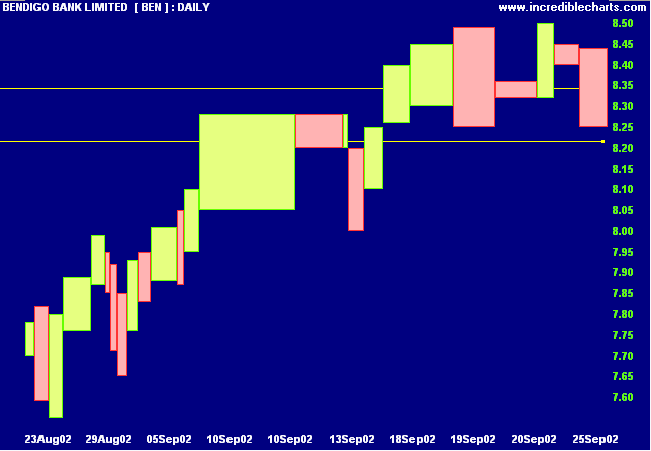

BEN is one of the few stocks in the ASX 200 to recently make a new high. As can be expected, relative strength (price ratio: xao) is rising steeply.

It is impossible to tell in advance the length of any primary movement, but the further it goes, the greater the reaction when it comes....

- SA Nelson

(after a record bull market in the 90's we should have anticipated the severity of the down-turn).

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.