The Chart Forum software has been upgraded - contributors will now require a password to identify themselves on the forum.

Trading Diary

September 23, 2002

The primary cycle trends down.

The Nasdaq Composite Index has broken below the July support level of 1200, closing down 3% at 1184.

The primary trend is down.

The S&P 500 lost 12 points to close at 833. The next support level is 800.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal, falling to 38% (September 20).

US 10-year treasury notes, at 3.68%, are trading at the lowest yields since 1958. (more)

New York: The spot gold price rose 60 cents to $US 322.70.

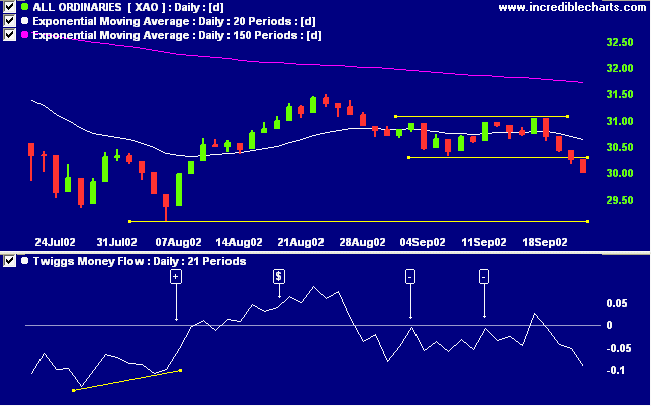

The MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines. Twiggs money flow signals distribution.

The primary trend is down.

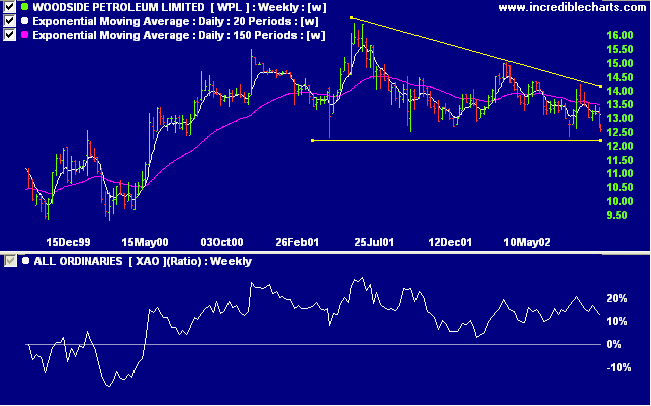

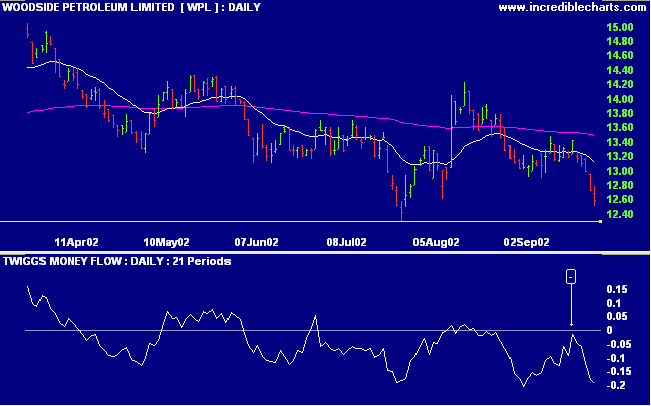

WPL is in a broad stage 3 top, forming a descending triangle over the past 18 months. Relative strength (price ratio: xao) is positive but the stock now appears set to test support at 12.30. A break below this level would have a target of 8.15 (12.30 * 2 - 16.45).

Success is not a destination, a place you can ever get to; it is the quality of your journey.

- Jennifer James

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.