New Directional Movement filters will be available next week.

Trading Diary

September 20, 2002

The primary cycle trends down.

The Nasdaq Composite Index formed an inside day closing at 1221. The next support level is 1200.

The primary trend is down.

The S&P 500 gained 2 points to close at 845. The next support level is 800.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflected a bear confirmed signal, falling to 40% (September 19).

The Federal Reserve changes its bias towards "economic weakness" but leaves interest rates unchanged. (more)

New York: The spot gold price eased 50 cents to $US 322.10.

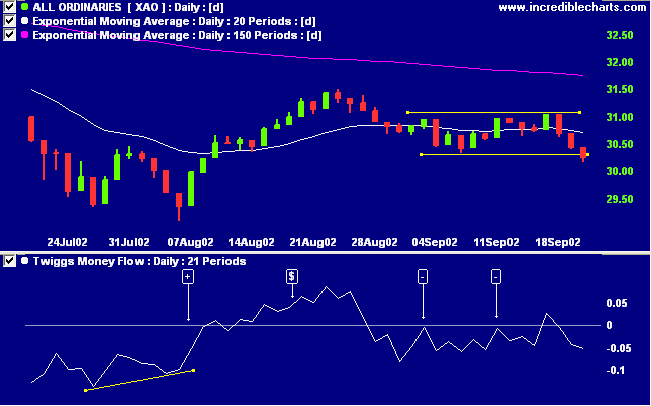

The MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines. Twiggs money flow signals distribution.

The primary trend is down.

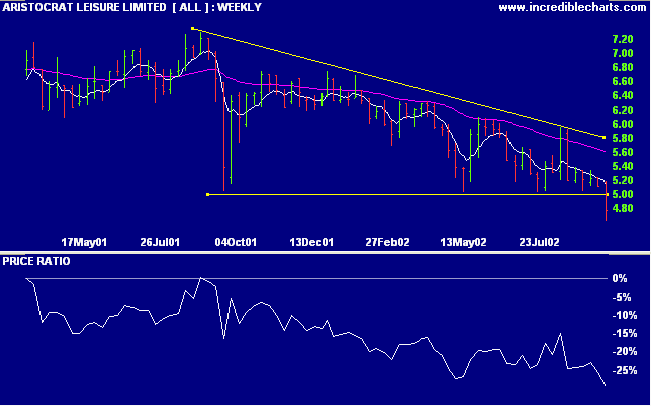

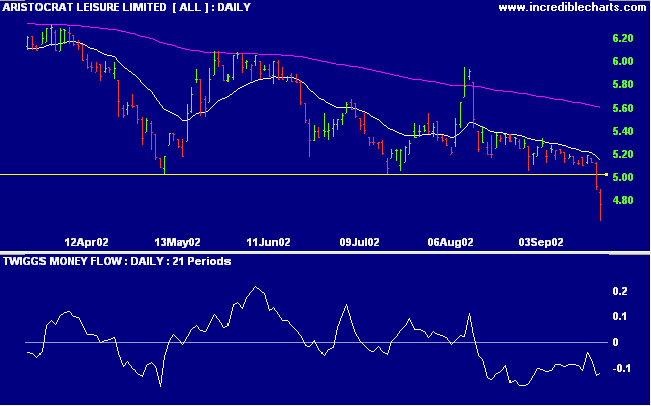

ALL has formed a bearish descending triangle over the past year, with a high of 7.30 and a low of 5.00. The breakout from the triangle pattern has a measured target of 2.70 (5.00*2 - 7.30). Relative strength (price ratio: xao) is falling and MACD is negative.

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 1 (RS is rising)

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 4 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is rising)

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) has fallen to 27 stocks that have gained more than 5% in the last month, compared to 99 on August 23. Notable sectors:

- Forest Products

What lies behind us and what lies before us

are tiny matters

compared to what lies within us.

- Oliver Wendell Holmes

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.