New Directional Movement filters include:

-

DI+ and DI- 14-day crossovers

-

ADX crossovers of the 20 (or 25)

level

-

Minimum or Maximum ADX values

- ADX reversals (by 2, 3 or 4 points)

Trading Diary

September 19, 2002

The primary cycle trends down.

The Nasdaq Composite Index also broke below recent support levels to close at 1216. The next support level is 1200.

The primary trend is down.

The S&P 500 closed 26 points lower at 843. The next support level is 800.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 18).

Computer services stocks, including IBM, fell sharply as Texas-based EDS downgrades third-quarter earnings by 80%, blaming the collapse of US Airways and WorldCom. (more)

A review of the hazards of short-selling. Put options may be a safer route. (more)

New York: The spot gold price continued to climb, closing up $US 2.30 at $US 322.60.

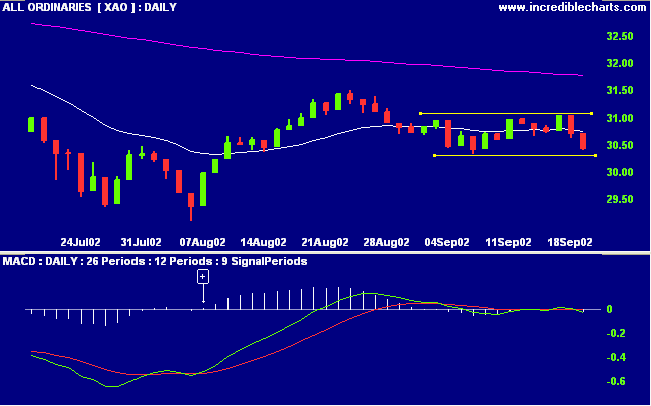

The MACD (26,12,9) joined Slow Stochastic (20,3,3) below its signal line. Twiggs money flow slopes down.

The primary trend is down.

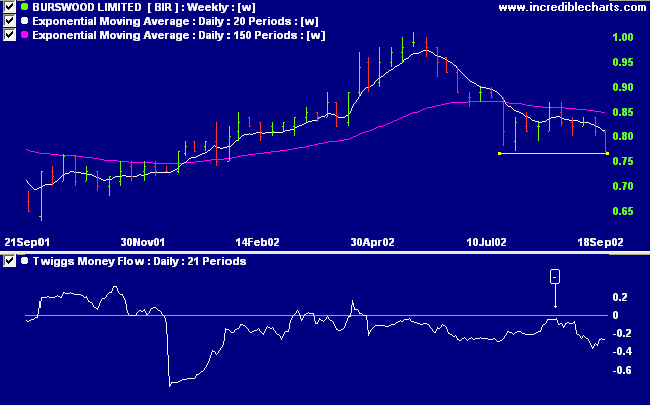

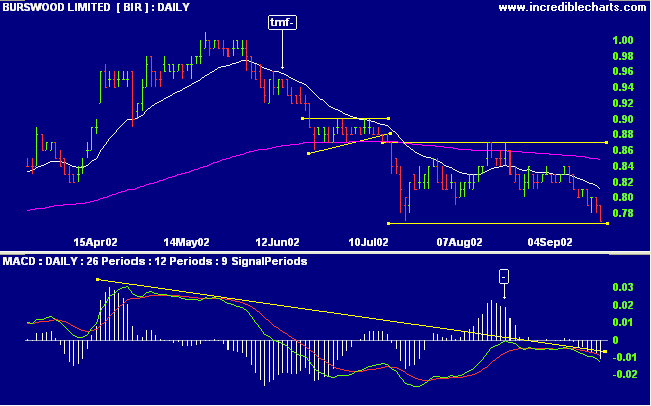

Casinos and gaming stocks have put in a strong performance over the past 12 months when compared to the overall market. BIR was no exception until mid-year. The stock has since crossed below the 150-day moving average with relative strength (price ratio: xao) falling. Price is now testing support at 0.77 after a strong bear signal on Twiggs money flow [-], where TMF failed to cross above zero on the last rally.

"It takes 100% relaxation and 100% concentration".

- Olympic clay target shooter, Michael Diamond.

(The ability to stay relaxed in pressure situations is one of the keys to successful trading)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.