New stock screens will be available soon, including:

-

Directional Movement filters.

-

Additional MACD filters.

- A volume filter to eliminate inactive stocks.

Trading Diary

September 18, 2002

The primary cycle trends down.

The Nasdaq Composite Index also saw a late rally, closing 1.25% down at 1252, after earlier breaking below support at 1250.

The primary trend is down.

The S&P 500 broke through the 870 support level, closing 4 points lower at 869.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 17).

The second largest bank in the US issues a third-quarter earnings downgrade, blaming bad loans and poor trading revenue. (more)

New York: The spot gold price closed up $US 3.50 at $US 320.30, reflecting uncertainty in equity markets.

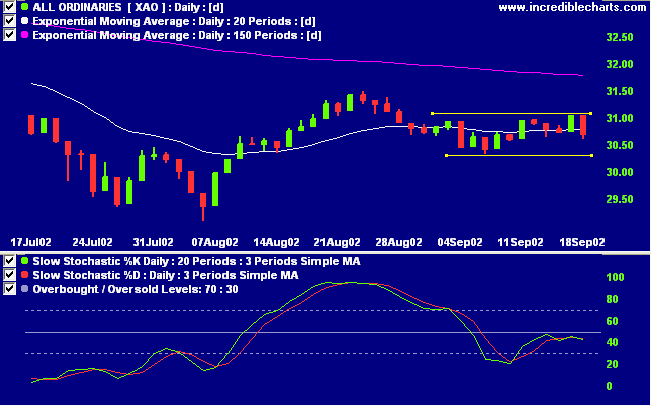

The Slow Stochastic (20,3,3) crossed back below its signal line. Twiggs money flow slopes down.

The primary trend is down.

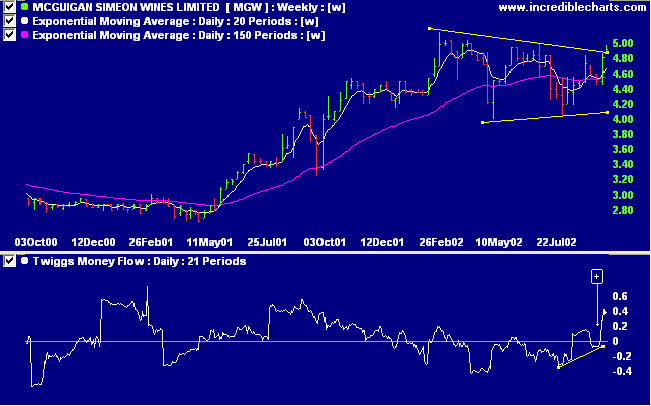

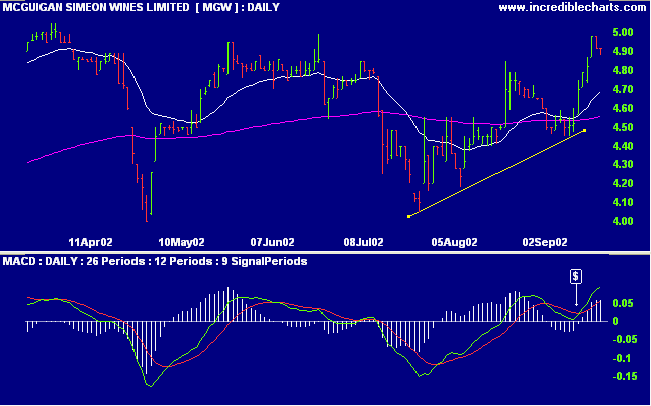

After a strong stage 2 up-trend MGW formed a triangle congestion pattern, failing to break above the February high. Price has rallied with strong volume over the past week, breaking above the upper boundary of the triangle pattern. Relative strength (price ratio: xao) is rising and Twiggs money flow is positive.

The bigger the base, the bigger the move.

And the bigger the top, the bigger the drop.

- old traders adage (from Stan Weinstein).

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.