New stock screens will be available soon, including:

-

Directional Movement filters.

-

Additional MACD filters.

- A volume filter to eliminate inactive stocks.

Trading Diary

September 17, 2002

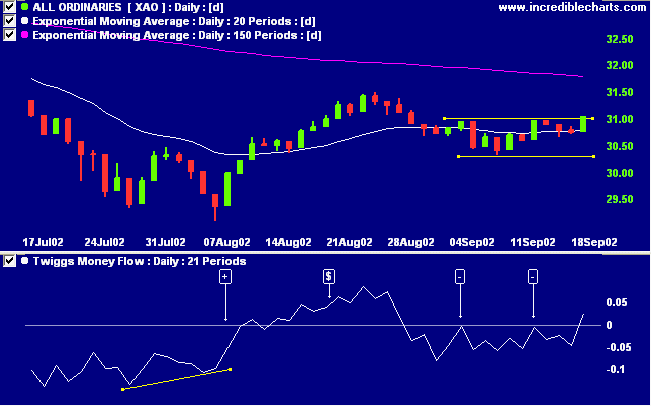

The primary cycle trends down.

The Nasdaq Composite Index is also testing support, closing 1.25% down at 1259. The primary trend is down.

The S&P 500 tested the 870 support level, closing 18 points down at 873. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 16).

McDonalds stock fell 12% after warning that profits will be hurt by slow sales in the US and Europe. (more)

Relief over the Iraqi announcement that they will admit weapons inspectors was short-lived as US officials discounted the move as "a tactical step" to head off strong U.N. Security Council action. (more)

Gold

New York: spot gold closed at $US 316.80, 40 cents down.

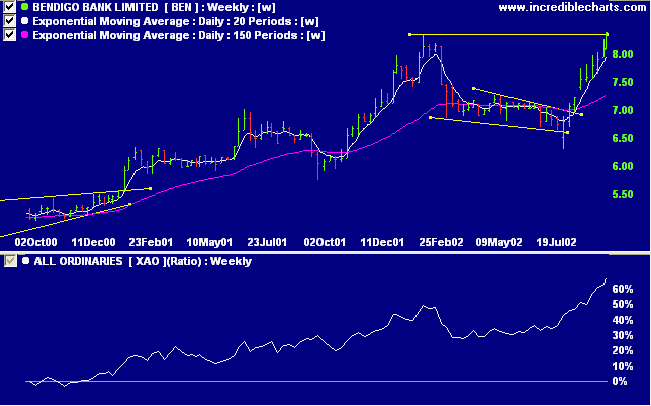

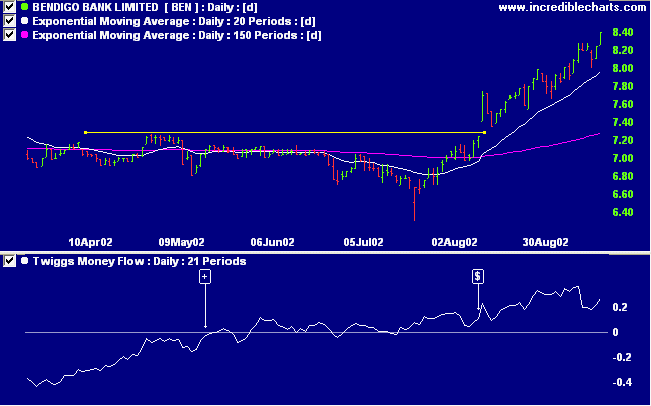

After appearing to form a stage 3 top, BEN has rallied strongly over the past 8 weeks to a new high of 8.40. Relative strength (price ratio: xao) is rising.

Don't try to pick the turning point on falling stocks, there are often several failed rallies before one succeeds.

Buy on breakouts above resistance.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.