We are planning to add Directional Movement/ADX to the list of Stock Screen filters

and welcome any comments or suggestions as to how the filter should be implemented.

Please post your comments at ADX on the Chart Forum.

Trading Diary

September 9, 2002

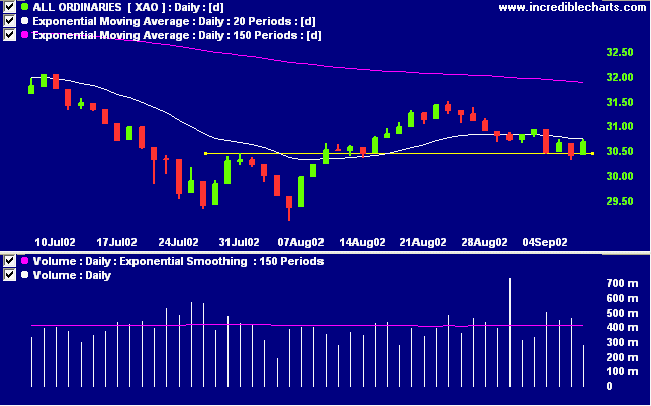

The primary cycle trends down.

The Nasdaq Composite Index formed an outside day to close 0.7% higher at 1304. The primary trend is down.

The S&P 500 gained 9 points to close at 902. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 6).

AOL is expected to post annual revenue of $US 1.7 billion compared to $US 2.7 billion last year, because of a slump in advertising sales and slowing subscriber growth. (more)

The primary trend is down.

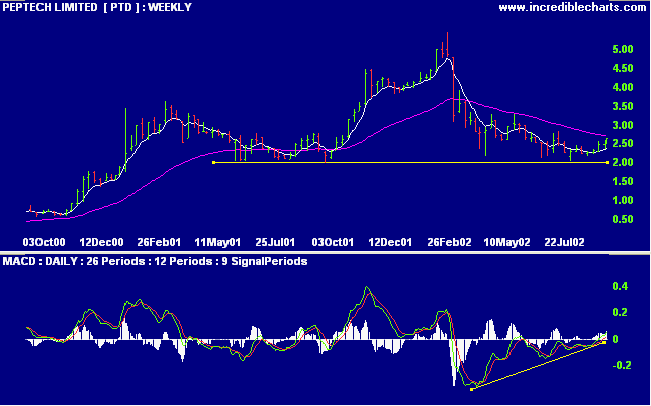

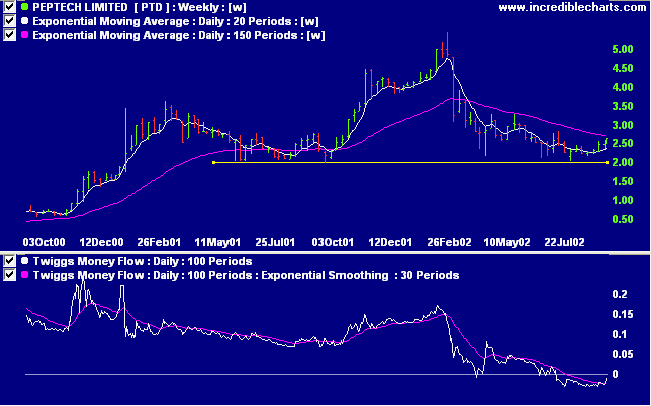

PTD may appeal to bottom-fishers after a 6-month bear-trend with price at roughly 50% of its previous high The biotechnology stock has held above support at 2.00, while MACD signaled a bearish divergence.

The conduct of successful business merely consists in doing things in a very simple way, doing them regularly and never neglecting to do them.

- William Hesketh Lever (founder of Lever Brothers)

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.