We are planning to add Directional Movement/ADX to the list of Stock Screen filters

and welcome any comments or suggestions as to how the filter should be implemented.

Post your comments at ADX on the Chart Forum.

Trading Diary

September 6, 2002

The Nasdaq Composite Index gapped upwards to close 3.5% higher at 1295. The primary trend is down.

The S&P 500 regained 14 points to close at 893. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (September 5).

Unemployment fell to 5.7% in August, from 5.9% in July. (more)

Intel stayed within the range of previous revenue and margin forecasts, bringing relief to investors who had expected worse. (more)

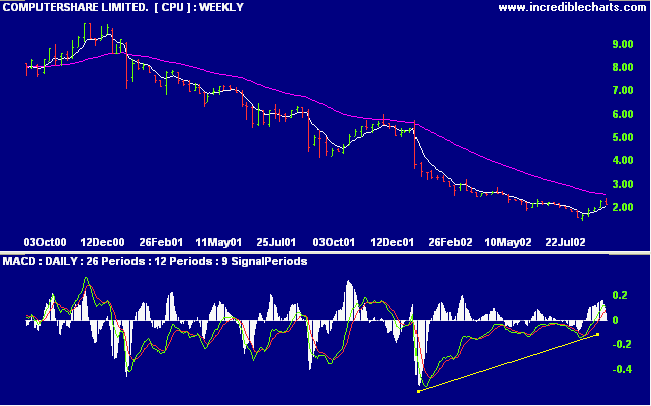

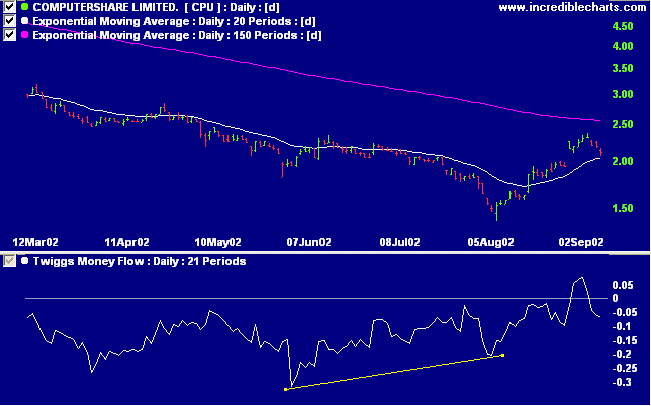

CPU has been in a stage 4 down-trend for the past 18 months, falling to 35% of its former high. As can be expected, relative strength (price ratio: xao) is weak while the 150-day moving average appears to be leveling. MACD signals a strong bullish divergence.

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 4 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is rising)

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1 (RS is rising)

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) has fallen to 65 stocks that have gained more than 5% in the last month. Notable sectors:

- Agricultural Products

- Construction Materials

Every cycle with a positive feedback leads sooner or later to catastrophe.

- Naturalist Konrad Lorenz

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.