See the What's New page for details.

To check that you have the current version, select Help >> About .

Trading Diary

September 3, 2002

The Nasdaq Composite Index dropped 3.9% to close at 1263. The next support level is at 1200. The primary trend is down.

The S&P 500 fell 38 points to close at 878. The next support level is at 834. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (August 30).

The ISM Purchasing Managers Index was a surprisingly weak 50.5, unchanged from July, while of greater concern is the fall in the New Orders Index to 49.7, from 50.4 in July. (more)

The Reserve Bank is expected to leave interest rates unchanged. (more)

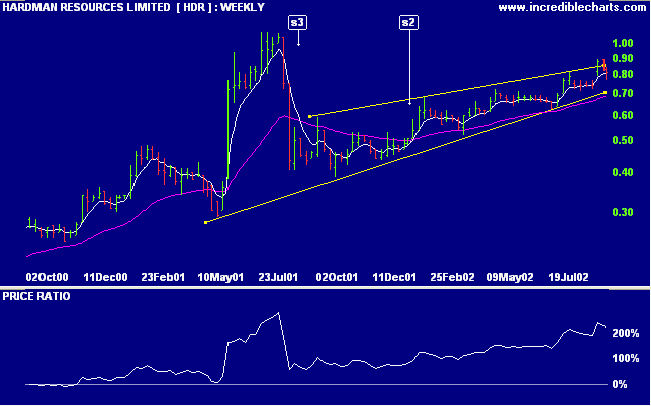

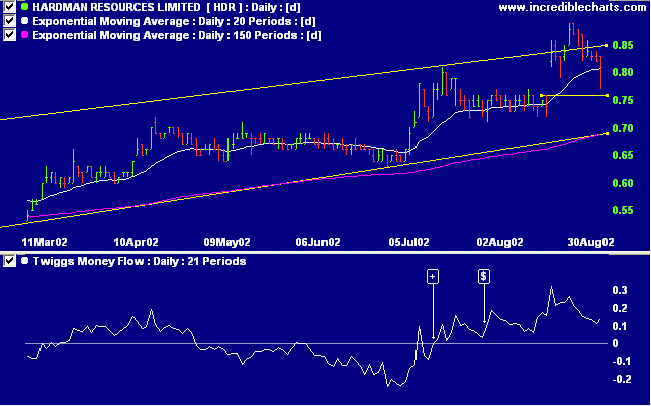

HDR has been trending strongly upwards, forming a rising wedge in the last year. Relative strength (price ratio: xao) is strong.

The same Nature that delights in periodical repetition in the skies is the Nature which orders the affairs of the earth.

Let us not underrate the value of that hint.

- Mark Twain

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.