See the What's New page for details.

To check that you have the current version, select Help >> About .

Trading Diary

September 2, 2002

The market is closed Monday for Labor Day.

The Purchasing Managers Index may show surprisingly strong but the jobs report is expected to paint a gloomier picture. (more)

The Reserve Bank faces a dilemna: raise interest rates to curb a ballooning property market and risk harming a more fragile general economy. (more)

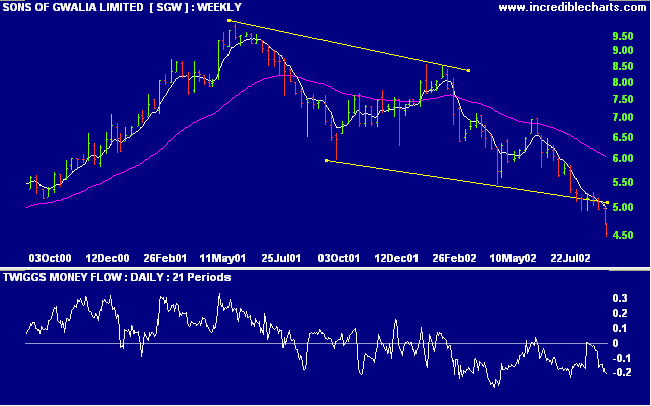

Value investors are scrutinizing stocks like SGW which show good dividend yields and are trading near 50% of their highs. SGW is in a stage 4 down-trend with the 150-day moving average falling steeply. MACD is negative and Twiggs money flow signals strong distribution, with the latest peaks barely crossing the zero line. I will wait until a falling stock has formed a stage 1 base and has positive signals on MACD and Twiggs money flow, before doing any "bottom-feeding".

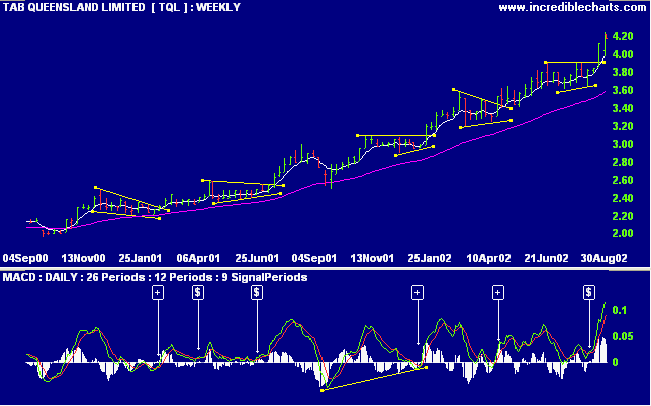

Conversely, I currently hold TQL and will continue to accumulate whenever there is a breakout from a continuation pattern.

TQL is in a stage 2 up-trend with positive signals from Relative strength (price ratio: xao), Twiggs money flow and MACD.

Set your maximum acceptable loss at a small enough level that you can exit without hesitation. Avoid trading situations where you place yourself under unnecessary pressure.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.