See the What's New page for details.

Trading Diary

August 29, 2002

The Nasdaq Composite came close to forming a key reversal, rising 1.6% to close at 1335, on an outside day. The secondary rally is still intact. The primary cycle is in a down-trend.

The S&P 500 closed unchanged at 917. The primary trend is down. The doji signals uncertainty.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (August 28).

Sun Microsystems warn that technology spending is weakening and first-quarter revenues will be at the low end of the previous guidance. (more)

Phillips Petroleum appears likely to win FTC approval for its $US 24.5 billion merger with Conoco. (more)

Technician Bernie Schaeffer believes that the Dow is inflated and will fall further. (more)

The allfinanz group reported a 21% drop in earnings despite strong operating performance. (more)

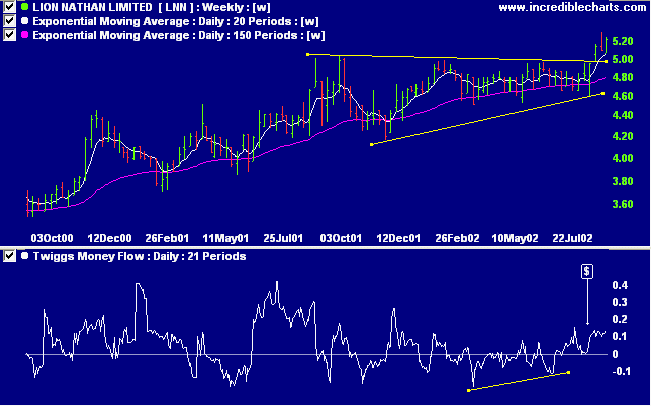

The brewer is in a stage 2 up-trend and recently broke out above an ascending triangle. Twiggs money flow and MACD show bullish divergences.

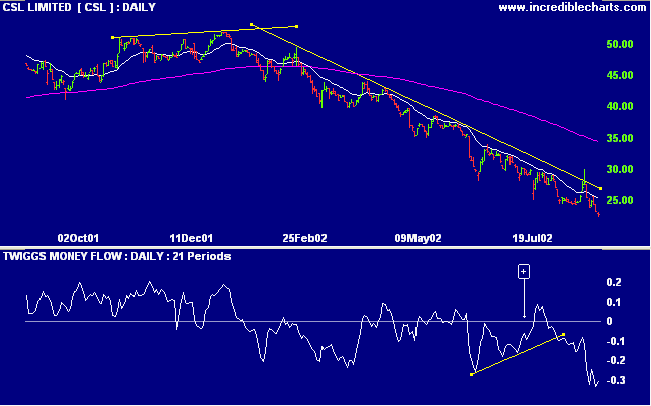

CSL is in a steep stage 4 down-trend, depicted by the 150-day moving average. Relative strength (price ratio: xao) is falling, while MACD is negative and Twiggs money flow signals distribution.

Reading Market Wizards by Jack Schwager, there is a recurring theme:

almost every successful trader fails dramatically before they accumulate the wisdom necessary to succeed.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.