See the What's New page for details.

Trading Diary

August 27, 2002

The Nasdaq Composite fell more than 3% to close at 1347. The primary cycle is in a down-trend, with a secondary rally.

The S&P 500 shed 14 points to close at 934. The primary trend is down, with a secondary correction.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 44% (August 26).

H-P reported pro-forma third-quarter earnings in line with analysts estimates but missed revenue targets. (more)

The Conference Board consumer confidence index fell to 93.5 in August, down from 97.4 in July. (more)

Intel, Microsoft and Wal-Mart led the decline as the outlook for computer sales, and retail in general, softens. (more)

The RBA promises to:

- change the formula for intercharge fees, charged between cardholders and retailers banks;

- allow retailers to pass on bank service fees to consumers; and

- end the restrictions on competition. (more)

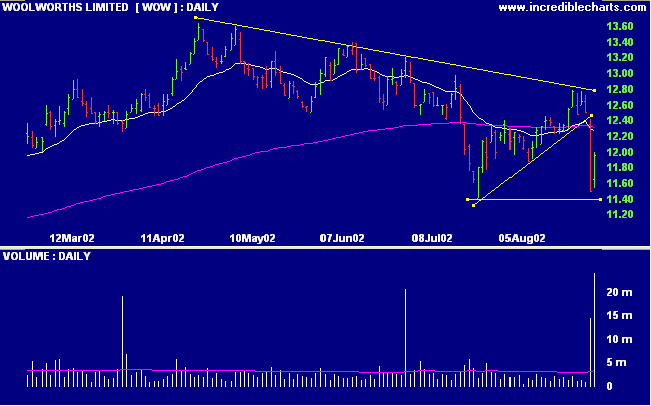

Woolworths explain that the fall in supermarket margins is due to employee training costs for 72 new Franklins stores. (more)

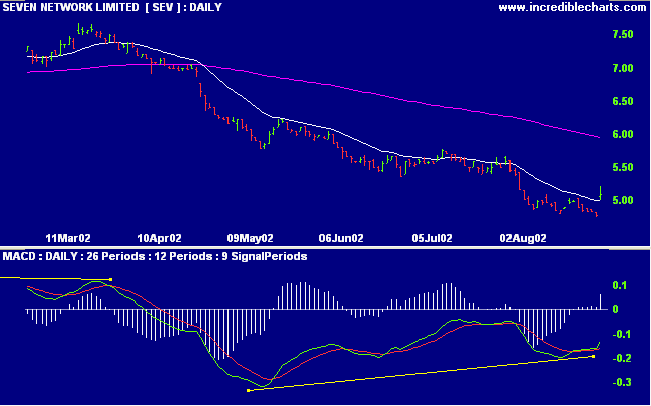

Seven Network drastically cut costs to produce an annual profit of $65 million, at the high end of forecasts. (more)

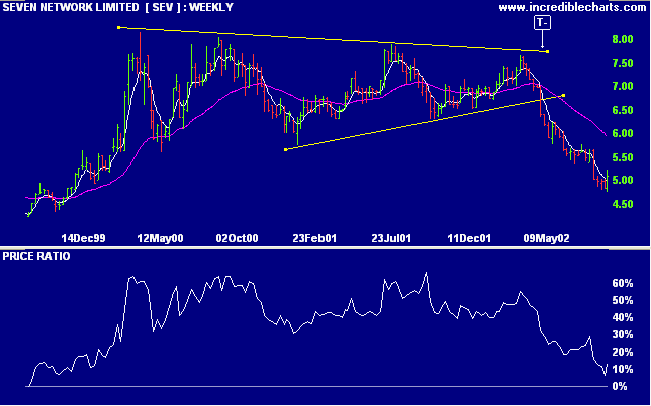

On the weekly chart: SEV broke downwards from a symmetrical triangle and has yet to reach the target of 4.45. The 150-day moving average still slopes downward while relative strength (price ratio: xao) has been in a decline for the past 6 months.

Your education earns you a living - your self-education earns you a fortune.

- Jim Rohn

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.