If you add more than 3 indicators, the indicator slots appear blank in the default screen view, because they are too small to all be displayed.

Users can now vary the number of indicator slots visible:

- Select View >> Visible Indicator Slots

- Select a number between 3 and 10

Trading Diary

August 26, 2002

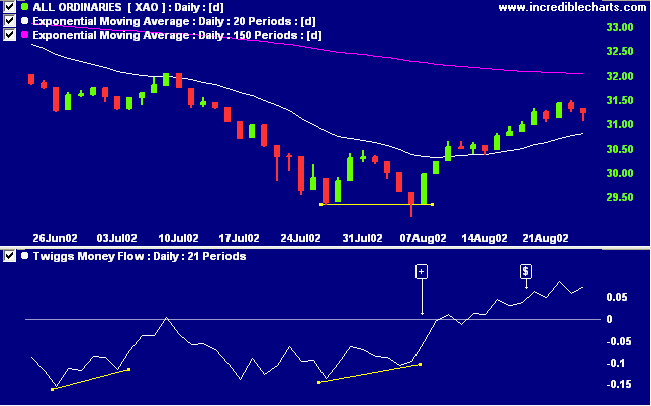

The primary cycle is in a down-trend.

The Nasdaq Composite also featured a late rally to close up 0.8% at 1391. The primary cycle is in a down-trend.

The S&P 500 gained 7 points to close at 947. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 44% (August 23).

The Swiss food and beverage group has made a $US 11.5 billion bid for candy-maker Hershey Foods. (more)

October crude oil futures closed up at $US 29.28 per barrel. (more)

The primary cycle trends down.

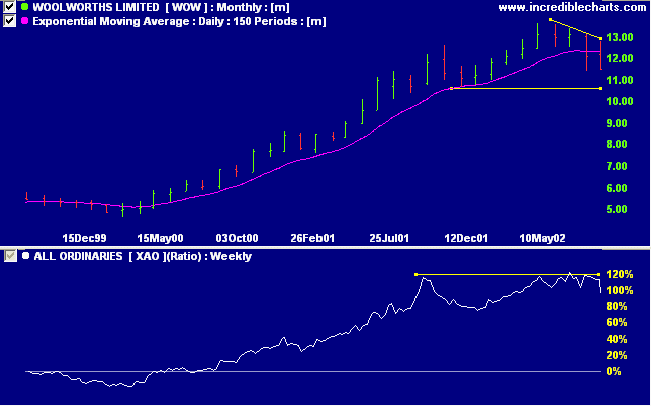

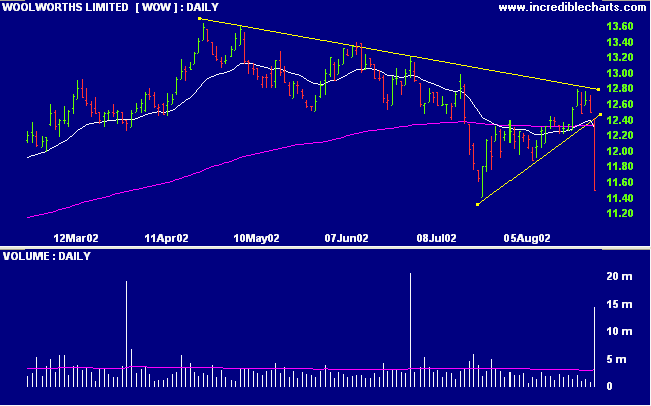

The retailer unveiled a 22% increase in annual net profit and predicted 10% to 15% growth in the next year, only to be punished by the market because of lower than expected supermarket margins. (more)

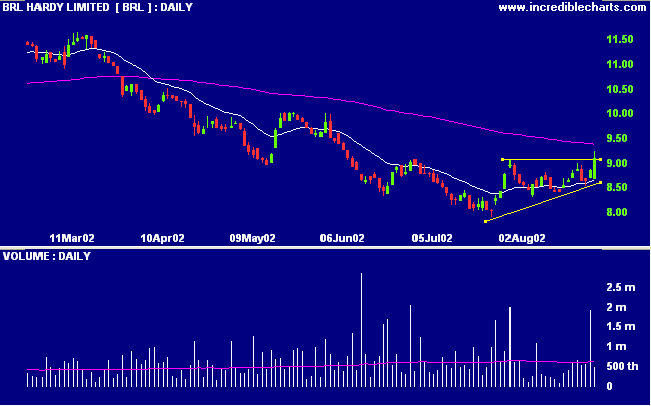

BRL rallied strongly to break above an ascending triangle formed over the last month. Yesterday's volume was low and the 150-day moving average still has a steep downward slope, so the breakout may be premature. Relative strength (price ratio: xao) has been in a decline for the past 6 months while MACD and Twiggs money flow completed bullish divergences in July.

Common sense is not so common.

- Unknown

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.