On August 15 the Dow broke above resistance at 8800. The magnitude of the earlier swings, from 7500 to 8800 and back to 8000, were large enough for them to be considered as secondary movements but the duration of the second correction (to 8000) proved too short for it to be considered as a separate cycle. This is more evident on a weekly chart. I had earlier stated that a break above 8800 would signal a reversal and my failure to explain must have confused readers.

A secondary cycle correction normally lasts from 3 weeks to 6 months and:

- Retraces at least 1/3 of the previous rally;

- Or has a magnitude of at least 10%;

- Unless it takes the form of a ranging market.

Trading Diary

August 23, 2002

The primary cycle is in a down-trend*.

The Nasdaq Composite descended 3% to close at 1380. The primary cycle is in a down-trend.

The S&P 500 lost 22 points to close at 940. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 44% (August 22).

The SEC is investigating more than $US 500 million in stock sales by AOL executives, while the company was making upbeat forecasts and supporting aggressive earnings estimates. (more)

Slow PC sales weaken Intel, AMD and hardware stocks. (more)

The primary cycle trends down.

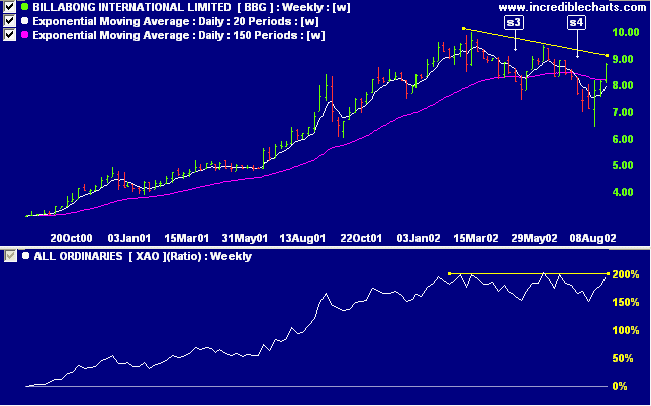

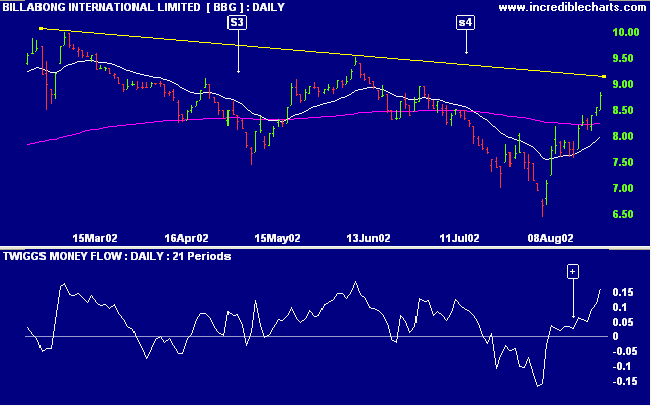

Strong results in the US and Europe boost Billabong annual profits by 45%. (more)

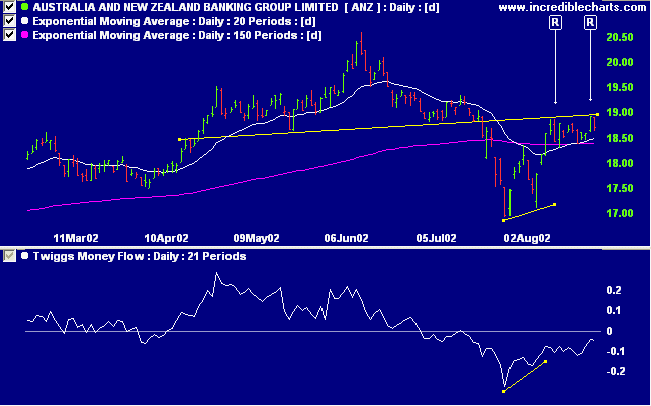

ANZ completed a head and shoulders reversal in July and has twice since then respected [R] the neckline. Relative strength (price ratio: xao) and MACD are positive while Twiggs money flow is rising but still below zero.

Stage changes are highlighted in bold.

- Energy [XEJ] - stage 1 (RS is rising)

- Materials [XMJ] - stage 4

- Industrials [XNJ] - stage 4

- Consumer Discretionary [XDJ] - stage 4

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4

- Property Trusts [XPJ] - stage 4

- Financial excl. Property Trusts [XXJ] - stage 4

- Information Technology [XIJ] - stage 4

- Telecom Services [XTJ] - stage 1

- Utilities [XUJ] - stage 2 (RS is rising)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) is teeming with stocks that have gained more than 5% in the last month (99 in total). Notably:

- Banks

- Oil & Gas

All you need to succeed in life are common sense and self-discipline.

- Alf Blackbeard

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.