Check every trade to ensure that it is within your maximum acceptable loss.

Reconcile your trading style to the maximum %

loss that you are prepared to take on a trade.

Otherwise you will seldom find trades that fit your

criteria.

Trading Diary

August 22, 2002

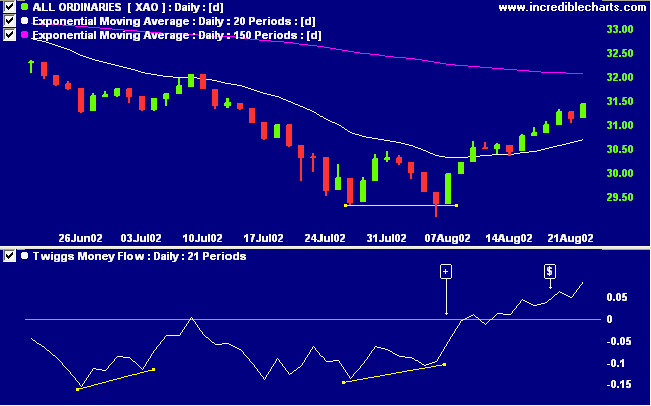

The Nasdaq Composite climbed 1% to close at 1422. The primary cycle is in a down-trend.

The broader S&P 500 gained the most, rising 1.4% to close at 962. The primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 42% (August 21).

An analyst upgrade of Microsoft helped the Dow rally above 9000 in the last hour of trading. (more)

The primary cycle trends down.

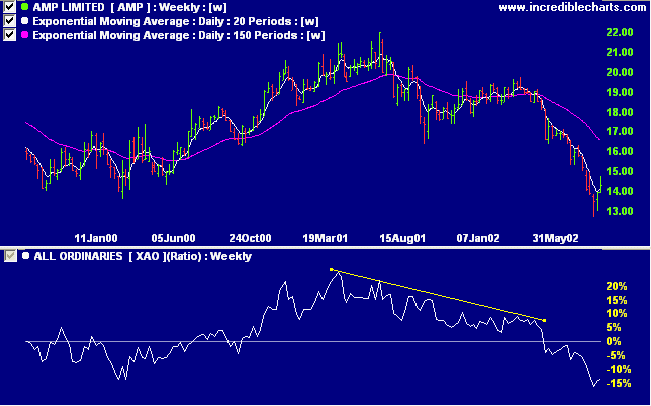

AMP has shelved a $ 400 million share buy-back and will raise $ 750 million of new equity, to rescue it's capital base. (more)

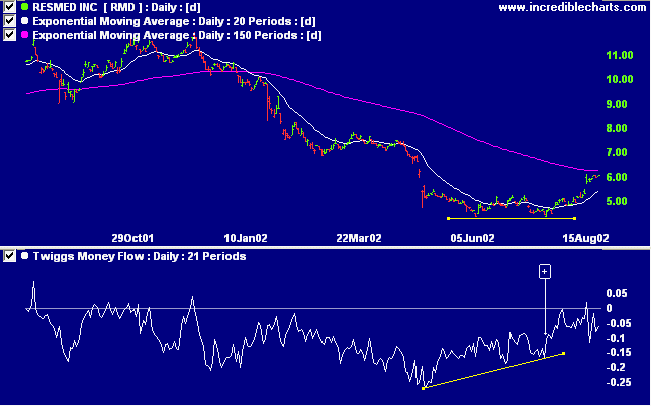

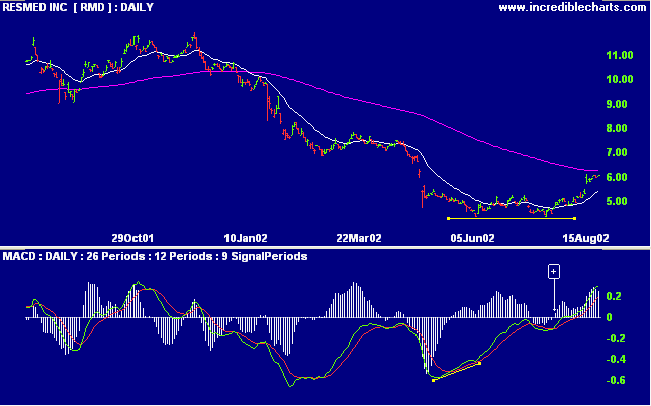

RMD has formed a stage 1 base. The 150-day moving average is leveling out and relative strength (price ratio: xao) is below zero but rising. Twiggs money flow shows a bullish divergence.

Experience teaches you to recognize a mistake

when you have made it again.

- Unknown

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.