A handy rule of thumb for identifying sectors with potential:

-

Conduct a stock screen on the ASX 200 or

ASX 300.

-

Sort stocks by Sector

-

Filter for stocks that are within 2% of

their 3 month high (3-month % of high: 98

minimum)

- Scan the results for industries that have at least two strong-performing stocks.

Trading Diary

August 21, 2002

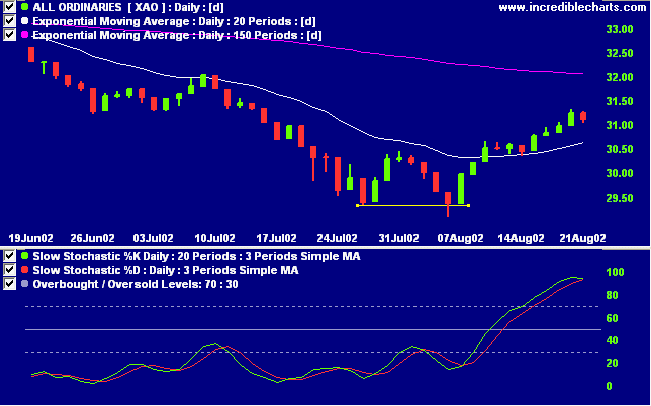

The Chartcraft NYSE Bullish % Indicator bull alert signal has now risen to 42% (August 20).

The rally on the Nasdaq continues, with the Nasdaq Composite closing up 2.4% at 1409. The primary cycle is in a down-trend.

The broader S&P 500 rose by 12 points to close at 949. The primary cycle is in a down-trend.

AOL Time Warner is to buy AT&T's interest in HBO and Warner Brothers movies for $US 3.6 billion. (more)

Three Federal Reserve policy makers share the view that further rate cuts are unnecessary. (more)

Michael Kopper pleads guilty to fraud and money-laundering charges and implicates former CFO Andrew Fastow in schemes to defraud investors of more than $US 1 billion. (more)

The primary cycle trends down.

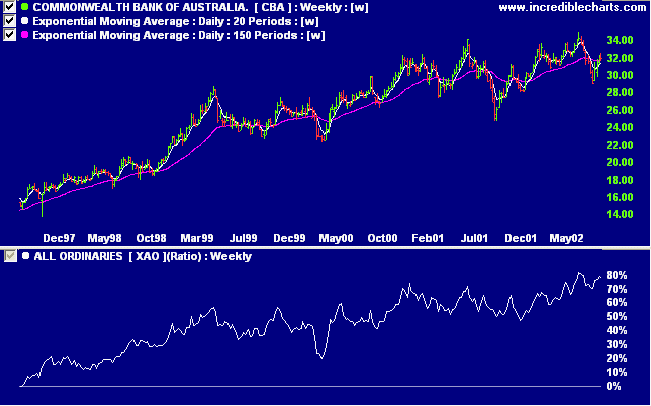

CBA posted an 11% rise in 2001/2 earnings, to $ 2.66 billion, and is to cut 1000 jobs. (more)

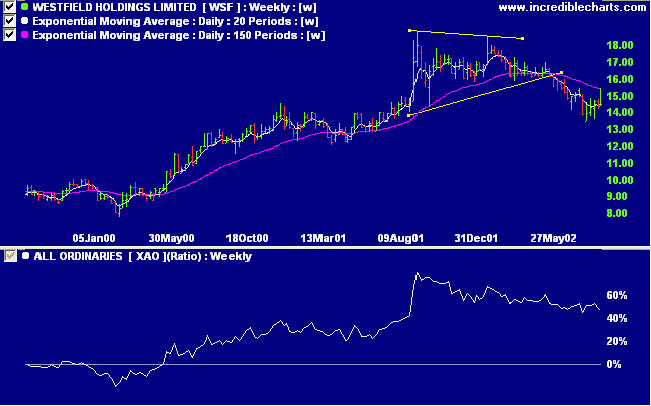

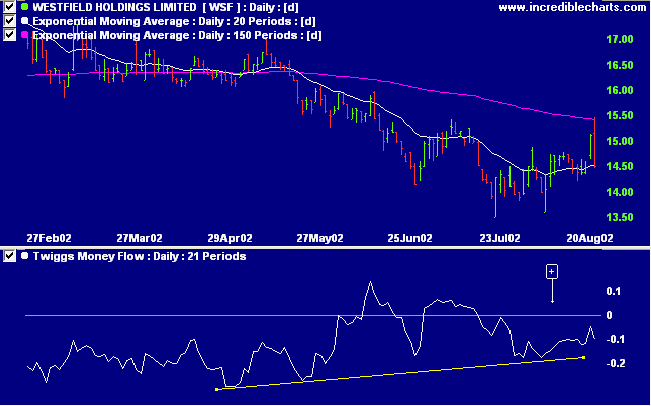

Westfield Holdings posted a 38% increase in annual earnings and a 31% increase in dividends.(more)

Some traders see a glass half empty and others a glass half full:

Take profits out of the middle of the trend and do not rue the fact that you missed entering right at the bottom

- that's where the risk is greatest.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.