Trading Diary

August 19, 2002

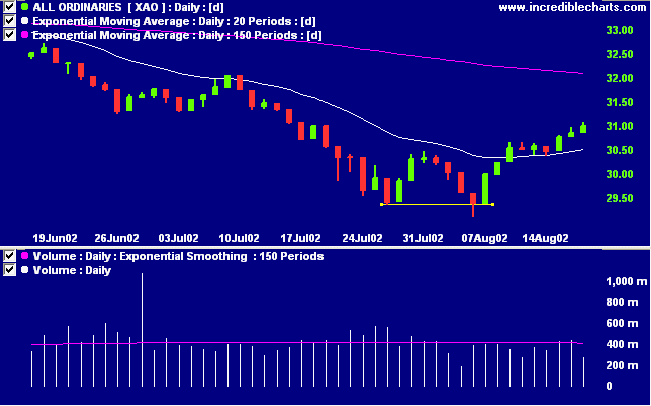

Primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal has risen to 38% (August 16).

The Nasdaq Composite increased 2.5% to close at 1394.

The primary cycle is in a down-trend.

The S&P 500 rallied 22 points to close at 950. The primary cycle is in a down-trend.

The following companies have failed to certify their accounts or asked for an extension of time:

- Enron

- Adelphia

- WorldCom

- ACT Manufacturing

- Alaska Air

- Adams Resources & Energy

- CMS Energy

- Dynegy

- Gemstar (partly owned by Newscorp)

- LTV

- McLeod USA, and

- TruServ

AOL Time Warner has qualified their certification to the extent of $US 49 million. (more)

The second largest home improvement retailer in the US report a 40%-plus increase in EPS for the second quarter. (more)

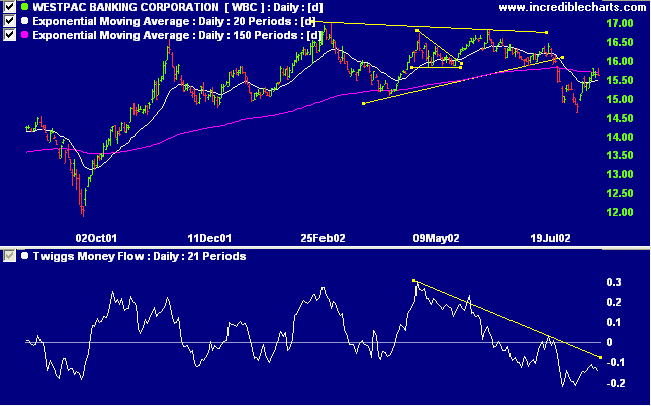

Westpac have acquired a controlling stake in Hastings Fund Management, managers of Australian Infrastructure Fund. (more)

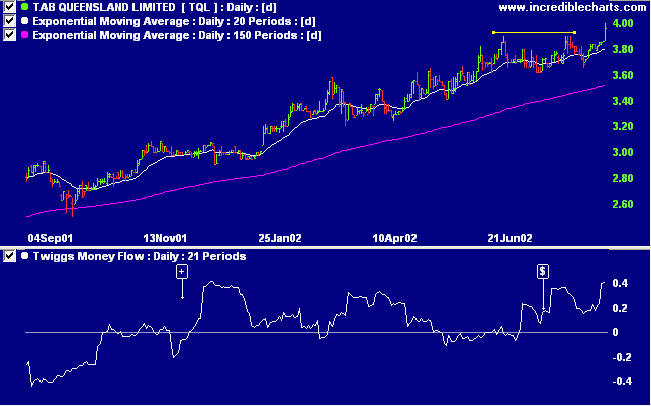

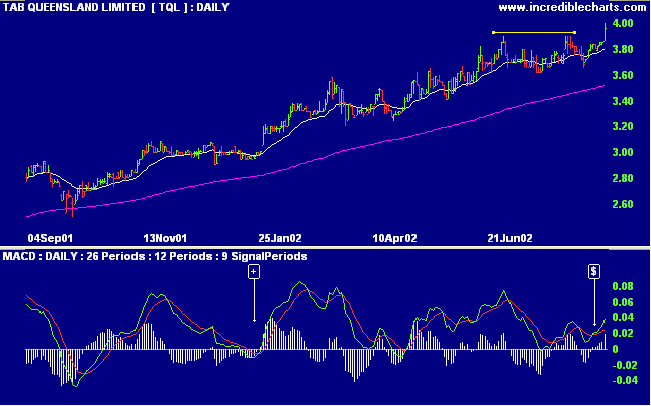

A strong second half enabled TQL to report a 25% increase in annual earnings.(more)

It is the big swing that makes the big money for you.

- Edwin Lefevre.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.